Are ARM Mortgage Rates A Good Deal?

You’re buying property and might be considering an Adjustable Rate Mortgage (ARM), with interest rates and payments that can fluctuate over time. Right now, ARM mortgage rates might meet your real estate goals better than fixed rate mortgages.

Verify your new rateAdjustable Rate Mortgage (ARM) Overview

Fixed-rate mortgage interest rates and payments stay the same throughout the loan’s life. That’s what makes them so popular with homebuyers.

In contrast, ARM interest rates adjust periodically throughout the loan’s lifetime. Fluctuations in the interest rate — and your payments — depend on your mortgage’s terms.

How ARM Rates Work

These loans aren’t as scary as they once were, which is why you’re probably considering one. Here’s what you need to know about ARM rates.

When mortgage lenders make fixed-rate loans, they have to deal with interest rate risk. That’s the chance that interest rates will rise, forcing them to pay more to depositors or investors, while they continue to receive the same low, fixed payment from their borrowers.

ARM Loans Are No Longer Mortgage Wallflowers In 2024

ARM loans transfer some of that risk from the lender to the borrower. In exchange for assuming some of this risk, you get to pay a lower interest rate — at least during the first years of your loan.

That difference in interest rates between the two types, aka the spread, makes ARMs more appealing than they would otherwise be..

How Big Is The Spread Between ARMs and Fixed Loans?

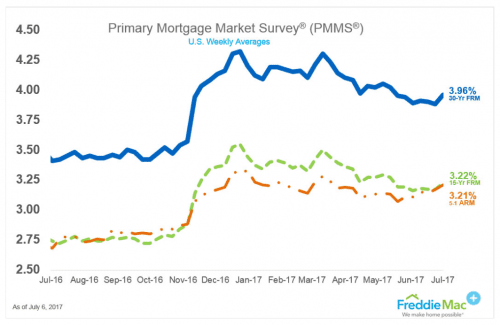

The chart below from Freddie Mac shows how the difference between 5/1 and 30-year loans changed over the last year.

ARM Rates Are Fixed: Sort Of

An important feature of ARMs is what’s called an introductory rate, a teaser rate, or a start rate.

It’s the rate lenders use when they advertise an ARM. And this rate applies only during the loan’s introductory period, which can range from one to ten years.

ARMs are named after this period: 1-Year, 3/1, 5/1, 7/1 and 10/1, for instance.

Pay attention to that first number; it shows how long the introductory period is. The loan’s fixed rate will be one, three, five, seven or ten years. The lower that first number, the shorter the fixed term, and the lower the rate should be.

3 Questions To Ask When Considering An ARM

The second number shows how often your interest rate will adjust after that fixed-rate term ends. For the loans listed above, it’s annually. A less-common loan is the 3/3 ARM, which adjusts every three years over its life.

How Lenders Set Adjustable Mortgage Rates

Mortgage rates for ARMs vary depending on the financial indexes the lenders use. The London Interbank Offered Rate (LIBOR) and 1-Year Treasury (CMT) are two of the most common. You can find them online on just about any financial site.

As of this writing, for instance, the 1-Year LIBOR rate is 1.76 percent, and the 1-Year CMT index is 1.20 percent.

Lenders add a percentage called the margin to the index when it’s time for your ARM to adjust or reset. The history of a specific index shows you how your rate could fluctuate over time.

If you have a 5/1 LIBOR ARM, for instance, and it has a 2.5 percent margin and is adjusting today, your new rate would be 2.50 percent plus 1.76 percent, or 4.26 percent. The average 1-year LIBOR rate over the last decade was 1.96 percent, so if the index hit its average, your new rate would be 4.46 percent.

ARM Caps Keep You Safe From Crazy Increases

Are you completely at the mercy of your loan’s index? No, thanks to a few safety features these loans have, called periodic caps and lifetime caps.

First, there is a limit to how high your rate and payment can go at its first adjustment. That is typically two or three percent, depending on the length of your fixed-rate period.

How ARM Rates Help You Get More When Interest Rates Are Rising

So, if your 5/1 ARM was fixed at 2.25 percent for its first five years, and the cap on its first adjustment is two percent, the highest your rate could go is 4.25 percent. If your annual cap is also two percent, the highest your rate could go the following year is 6.25 percent.

But that’s not all. A lifetime cap ensure your interest rate won’t rise more than a set amount over the loan’s life. It may be expressed as a percentage above your start rate, or a maximum interest rate. Federal law requires lifetime caps on most ARMs.

When An ARM Is Your Cheaper Choice

When you’re pretty sure you’re not staying your home more than your ARM’s introductory period, you can save a lot of money with an ARM. Since the average time people stay in home is seven years, a 5/1 or a 7/1 ARM is ideal for most buyers.

It actually may be smart to avoid a fixed rate loan for a starter home or any house you know you’ll keep fewer than 12 years, says Mortgage Professor Jack Guttentag. “Beyond that,” he states on his Web site, “The cumulative effect of rate increases will probably outweigh the benefits of low rates in the early years.”

Should You Refinance Your ARM To Another ARM?

Usually, however, if you’re staying beyond the initial fixed rate period, you can refinance into another ARM. Be as knowledgeable as possible and know your options before choosing ARMs, so they remain the cheaper option.

What Are Today’s Mortgage Rates?

Current ARM rates are very attractive, with the 5/1 coming in this morning at 3.25 percent. That’s the same as the 15-year fixed rate, but you don’t have to make a high 15-year payment to get it. You can compare rates for all ARMs from various lenders online and choose the best loan for your situation.

Time to make a move? Let us find the right mortgage for you