Housing cooperative — not all “5th Avenue”

When you think of co-ops, you might envision luxury condos where super-rich, celebrities or politicians live. But what if you could you buy one for less than the market rate rent? You can if you buy into a limited-equity housing cooperative (LEC).

How your loan size affects your mortgage rate

It’s possible to live in posh areas, San Francisco, New York City or Washington, DC at a fraction of what other area residents pay. But, these co-ops are most prevalent in the East Coast communities of all income types

Verify your new rateIs cooperative housing the same as a condominium?

What are these and how do you buy into one of these relatively inexpensive buildings? Condominiums and cooperatives, or co-ops, are similar but have some really important legal distinctions.

Condos and co-ops can look the same, and so can their neighborhoods. What you pay depends on the unit’s location, type and features. So it can be an apartment, townhouse or single-family home. Like co-ops, you can buy your unit with a mortgage, and you can usually deduct your interest at tax time. But that’s where similarities end.

The condominium: You buy it, you own it

When you purchase a condominium, you own your unit. It may be attached, in a high-rise, or a detached or semi-detached house. There may be just four units, or 4,000 units. But there will always be common area in which you also have ownership interest. And there will always be a homeowners association (HOA).

HOA dues can make condos more costly than houses

Condo owners must adhere to a set of covenants, conditions, and restrictions (CC&Rs). Condo owners pay HOA dues, which can range from almost nothing to thousands a month, depending on the location and amenities. It’s smart to look fees and rules over before buying.

The cooperative: You sort of buy it, you lease it

Cooperative housing, aka co-op, is a different structure of ownership altogether. When you purchase a co-op, you won’t own the unit like you would a condo. This means you don’t get a deed to the property. Instead, you’ll own shares (membership) in the co-op’s nonprofit corporation.

Advice for renters: when your roommate moves out and you're not on the lease

So while you own your shares, you actually lease your unit from th the corporation. You’ll also share responsibility for operating the co-op, including for common-area maintenance or other tasks.You are also entitled to equal access to the common areas, and to vote for members of the Board of Directors(the co-op managers).

Similar to condo owners, co-op residents also pay maintenance fees. They can also range from negligible to extravagant.

Financing differences between co-ops and condos

When you buy a unit in a condominium community, the lender examines the HOA’s finances, the condition of the property, existence of any lawsuits, the percentage of renters versus owner-occupants, and other factors before approving your loan.

Getting a mortgage for a co-op involves a similar process, except that it’s not called a “mortgage” because technically, you are not purchasing real estate.

Loans for warrantable and non-warrantable condos

The cooperative association or corporation may have a mortgage on the entire project. If so, it’s called a “blanket” mortgage. You can pay cash for your shares in the cooperative, or you can borrow with a “share loan” that’s similar to a mortgage.

Fannie Mae, for example, purchases share loans on approved co-ops. The application process is very similar to that of applying for a condo mortgage. Mortgage lenders must investigate the association or corporation carefully, making sure that it’s a safe investment for them.

Cooperative (or uncooperative) living

Expect to get to know your neighbors well, since you’ll constantly work together to run the corporation and manage the building. Co-op communal living includes restrictions on how you live in your unit.

Those rules include who can live with you (pets or roommates, for instance), and whether you can rent or sublet. Unlike condos, co-ops may also dictate (in compliance with fair housing laws) how and to whom you can sell your shares.

How to check out your neighbors before buying a home

As with condos, co-op associations may impose restrictions on improvements to your home. Building residents often enforce those dictates strictly, and that level of connection with neighbors may either excite or horrify you.

When you sell your co-op, you’re selling shares in the building, not the unit itself, and the co-op board has to approve the sale.

Market rate co-ops

You can buy into almost any co-op for the equivalent of a down payment on a property in your area of interest. The majority of cooperatives are market rate, while the rest are limited equity co-ops (LECs).

Developers build market rate co-ops to earn a profit, as do those who purchase their units and sell them later. These are the upscale buildings most people visualize when they think co-op.

Home prices in 2017: Are we facing another bubble?

When you sell your shares, your prospective buyer is also a tenant and may have to be approved by a very picky board of directors. But the money you make on the transaction is all yours.

Limited or zero equity co-ops

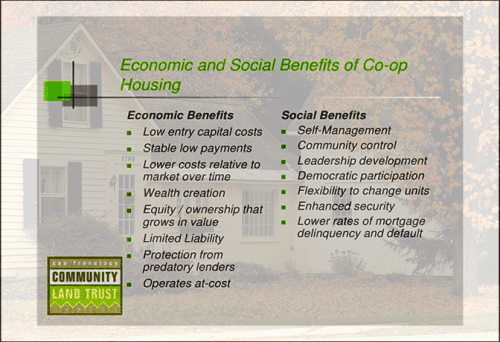

On the other hand, long-term availability of affordable housing is the purpose of LECs. Profitability for shareholders has nothing to do with them.

So, most are income-restricted, meaning that those whose income exceeds the project guidelines can’t buy shares. It allows these residents to have a nicer place than they could normally rent with the same monthly payment.

How to buy a house with low income

Because of this benefit, the LEC board restricts the amount of equity you can earn. Some are even zero equity co-ops, requiring that you sell for no more than you paid. The increase in property value reverts to the association, which allows it to subsidize owners who have modest income.

Because of their far below market rate prices and monthly costs, there’s a waiting list for many. Put your name on every list for which you qualify, and prepare to wait.

Finding the ideal limited equity co-op

Co-ops are heavily concentrated in specific areas of the country, especially on the coasts, and they’re easiest to locate there. Because they come in all housing types, know what you want before you start looking. Specialized databases, qualified real estate agents, online searches, classified ads and word-of-mouth are ways to locate them.

But with LECs, most of the time the city that funds them or oversees their federal funding controls access to them. That keeps them affordable and accessible to all who qualify.

Tips for buying

Buy these like you’d buy any other corporate shares. Ask multiple questions about how the LEC’s corporation runs to learn its financial health, making sure it’s solvent and run well. Know the co-op board’s standard practices.

First-timer's complete guide to buying a home

But recognize that, unlike a condo board’s approval process, the LEC’s screening process is more competitive, because others want the unit, too. It’s the co-op board that decides who gets offered the unit, so expect an intense interview.

- The approval process might involve interviews and character references, as well as your work, financial, and credit history. When a government agency administers an LEC, your application and financial information go to them first for approval. Then you go through the co-op board’s interview process.

- When an agency isn’t involved in the purchase, you’ll provide financial and personal information to your future neighbors, the LEC co-op board. But, it’s as essential you carefully review the buildings’s bylaws and financial documents, too.

- Co-op boards can reject you for any non-discriminatory reason, so it’s crucial to make a good impression. But the process also is a way to help you decide if you can live with these prospective new neighbors.

Getting financed for your LEC

Whether you can get a conforming (Fannie Mae or Freddie Mac) mortgage depends in part on the property state. For instance, Fannie Mae states, “No co-op share loan from Pennsylvania may be secured by a ‘limited equity’ co-op.” On the other hand, Fannie and Freddie are willing to back LEC share loans under the right conditions and in most states.

The price of some LECs is so low you’ll need cash to for your “buy-in” or share purchase, because most mortgage lenders have minimum sizes for the loans they make.

Mortgages for tiny homes, "green" homes, log homes and other oddball properties

It can be harder to get financing for LEC shares, because fewer lenders offer them.

Your best source for finding financing may be a specialized real estate agent or the co-op’s board. The health of the LEC corporation is as critical as your financial stability, because loan approval depends on both.

Getting one of these LECs can be a beast, but you can save a ton on housing. Once you’re in one, you’re golden as long as you get along with your neighbors.

What are today’s mortgage rates?

Current mortgage rates for condos and co-ops are about the same as those for traditional dwellings. And that’s a good thing, because those rates are still very attractive.

Time to make a move? Let us find the right mortgage for you