The rules for a jumbo loan refinance have changed

Jumbo refinance rates used to be lower than conventional rates, but those days are gone.

Today if you need an extra-large mortgage you’ll pay a higher rate and face tougher terms. And lenders may want special favors — like a million-dollar deposit, for example.

But mortgage rates are still near all-time lows. And jumbo loan holders may be able to save big by refinancing into a lower rate.

So how do you know whether it’s the right time to do so? And how low can you realistically expect jumbo refinance rates to be?

Verify your jumbo refinance eligibilityIn this article (Skip to...)

- Mortgage rates have plummeted

- How low are jumbo refinance rates?

- Do you qualify for a jumbo loan refinance?

- The impact of COVID-19 on jumbo loans

- Why mortgage lenders are cracking down

- Should you refinance a jumbo loan right now?

Mortgage rates have plummeted

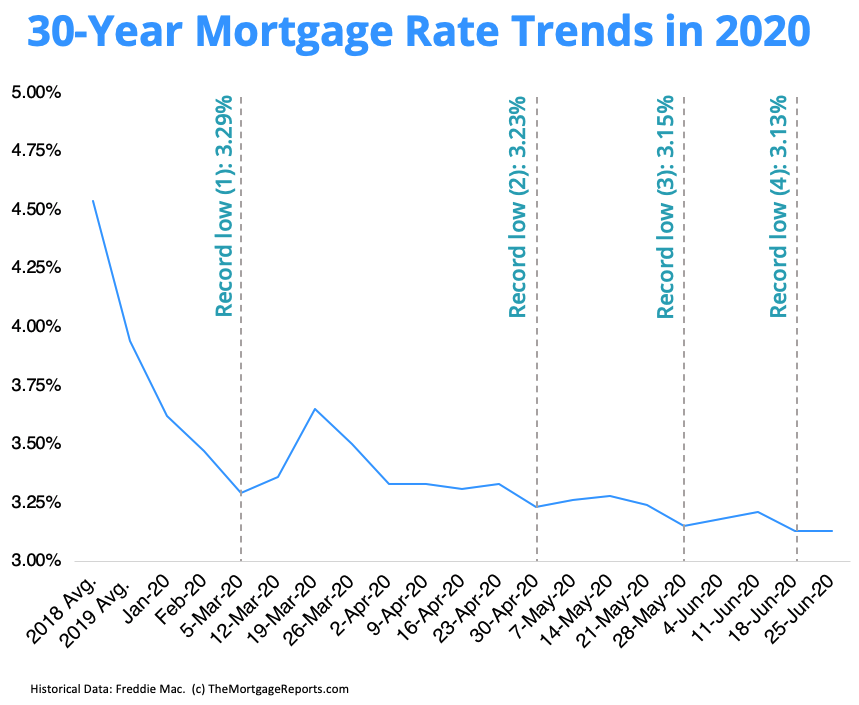

During the past two years — and especially in recent months — mortgage rates have sunk to historic lows.

Average 30-year mortgage rates dropped from 5% in 2018 to just 3.03% in July 2020. Mortgage rates in the 2% range have even become a reality for some.

This massive drop in mortgage rates suggests that millions of borrowers can benefit from refinancing.

In fact, Black Knight reports that over 13 million homeowners could currently drop their rate by at least 0.75%.

And “tappable equity,” the amount available to homeowners with mortgages via cash-out refinancing or home equity lines, “rose by 8% year-over-year in the first quarter of 2020 to a record high of $6.5 trillion.”

For homeowners with jumbo loans — mortgages greater than $, in most areas — the benefit from refinancing or cashing out equity could be great.

The bigger your loan, the more you stand to save every month by lowering your interest rate. And the more equity you have, the more you may be able to cash out.

But, those benefits depend on how low an interest rate you qualify for — and whether you’re able to refinance according to new rules.

Verify your jumbo refinance eligibility

How low are jumbo refinance rates?

The relationship between conforming mortgage rates and jumbo mortgage rates has flipped.

According to the Mortgage Bankers Association, conforming loans — those meeting local loan limits — averaged 3.26% for the week of July 8th.

Jumbo loans at the same time were priced at 3.52%.

For the week of November 7, 2018 the numbers looked very different. The MBA reported back then that conforming loan rates averaged 5.15% while jumbos were at 4.97%.

| Conforming Mortgage And Refinance Rates | Jumbo Mortgage And Refinance Rates | |

| November 2018 | 5.15% | 4.97% |

| July 2019 | 3.26% | 3.52% |

The bottom line: Jumbo loans used to have lower rates than conventional financing, but now you’ll pay more for jumbos.

Why is that? Because lenders see more unknown risks in the COVID-19 economy. In this new environment, all loans are riskier, and big loans doubly so — thus the higher pricing.

Do you qualify for a jumbo refinance?

If you want to refinance with a conforming loan or government-backed mortgage, there are known loan limits and well-established qualification standards.

With jumbo mortgages, the story is different.

Lenders have flexibility to set their own requirements because the loan will not be insured or guaranteed by a governmental agency.

That means lenders could have different standards for:

- Income requirements

- Minimum credit score

- Home value and equity requirements

- Cash reserves

- “Seasoning” — meaning how long your current loan has been outstanding before you can refinance

The new Wells Fargo rule — which requires a $1 million deposit at the bank to qualify for a jumbo refi — illustrates this point.

The bank doesn’t just want interest. It wants something else, like a big cash deposit, to verify the customer is an extra-safe borrower who won’t default.

Of course, not all lenders are setting the bar as high as Wells Fargo. You can still find jumbo refinance options with a lot less than $1 million in the bank.

But you’ll have to be extra thorough when exploring your options.

Remember, it’s not just about qualifying for the loan. Your refinance rate will also depend on how ‘strong’ a borrower the lender deems you to be. So be sure to shop around.

The impact of COVID-19 on jumbo loans

It’s not just Wells Fargo and it’s not just jumbo loans that are becoming tougher to get. Historically-low rates are out there, but lender requirements have gotten tighter and tougher in recent months.

Mike Fratantoni, chief economist with the Mortgage Bankers Association (MBA), told The Mortgage Reports that “the economic uncertainty and impact from the COVID-19 pandemic has had an impact on mortgage credit availability — despite the fact that borrower demand is very strong because of record-low mortgage rates.”

“The COVID-19 pandemic has had an impact on mortgage credit availability... There are fewer investors willing to purchase jumbo loans” —Mike Fratantoni, Chief Economist, Mortgage Bankers Association

“MBA’s mortgage credit availability index has declined to levels not seen since April 2014,” Fratantoni continued.

“Lenders are navigating the nascent economic recovery while also accounting for the risk of a borrower being affected by a job loss and requesting forbearance.

“There are fewer investors willing to purchase jumbo loans and those with lower credit scores... And many banks, while still focused on mortgage lending, are also dealing with borrower demand for other credit products.”

Why mortgage lenders are cracking down

The pandemic also creates an entirely new set of lender problems.

Lenders must verify that borrowers have the ability to repay their loans. Verifications have traditionally meant checking such things as income and employment.

But more than 45 million people are suddenly unemployed. And job security is no longer so certain — another reason investors are a lot less interested in buying jumbo loans than in the past.

All this isn’t to scare you off or say refinancing is impossible, but rather to show why lenders are cracking down on requirements.

For qualified borrowers willing to shop around, low rates are available and refinancing is still very possible.

Should you refinance a jumbo loan right now?

Rates today are at or near historic lows. It makes sense to look at jumbo mortgage rates in several situations.

- If you’re a qualified borrower, with a good credit score, low debt, and cash reserves

- If you have a job that will continue in the face of the pandemic

- If you have not refinanced in the past two years

If this is your situation, check rates and find out what you qualify for to see how much you could save — or cash out — by refinancing your jumbo loan.

Time to make a move? Let us find the right mortgage for you