What is mortgage amortization?

“Mortgage loan amortization” is the process of paying a home loan down to $0. Your “amortization schedule” tracks this process of paying off the loan.

The basic concept of mortgage amortization is simple: You start with a loan balance and pay it off in equal installments over time. But when you look closer at each payment, you’ll see that you pay off your loan principal and interest at a different pace.

Understanding how your amortization schedule works will help you when it comes to home equity, refinancing, and paying off your mortgage early. Here’s what you should know.

Check your mortgage loan options. Start hereIn this article (Skip to...)

- Amortization explained

- Amortization and loan payments

- Amortization schedules

- Why amortization matters

- Long vs. short amortization

- Can you change amortization?

How mortgage loan amortization works

Most mortgage loans are ‘fully amortized.’ That means they’re paid off in monthly installments over a set period of time. At the end of that period, the loan balance reaches $0.

“Loan amortization is the process of calculating the loan payments that amortize — meaning pay off — the loan amount,” explains Robert Johnson, professor of finance at Heider College of Business, Creighton University.

“On a fully amortizing loan, the loan payments are determined such that, after the last payment is made, there is no loan balance outstanding,” Johnson explains.

If you have a fixed-rate mortgage, which most homeowners do, then your monthly mortgage payments always stay the same. But the breakdown of each payment — how much goes toward loan principal vs. interest — changes over time.

As a result, each payment has a different impact on your mortgage balance.

Amortization and your mortgage payments

At the beginning of your amortization schedule, a larger percentage of each monthly payment goes toward loan interest. At the end, you’re paying mostly principal.

This transition — from mostly interest to mostly principal — affects only the breakdown of your monthly payments. If you have a fixed-rate mortgage, the amount you pay each month toward principal and interest together will stay the same.

So, since it doesn’t affect your total payment amount, why does the breakdown of your payments matter?

Your payment breakdown is very important because it determines how quickly you build home equity. Equity, in turn, affects your ability to refinance, pay off your home early, or borrow money with a second mortgage.

The longer the term of your loan, the longer it takes to pay down your principal amount borrowed, and the more you will pay in total toward interest.

That’s why a shorter-term loan, like a 15-year, fixed-rate mortgage, has a lower total interest cost than a 30-year loan with a fixed rate.

Check your mortgage loan options. Start hereAre all mortgage loans amortized?

Almost all mortgages are fully amortized — meaning the loan balance reaches $0 at the end of the loan term.

The same is true for most student loans, auto loans, and personal loans, too. Unlike with credit cards, if you stay on schedule with a fully amortized loan, you’ll pay off the loan in a set number of payments.

Among mortgages, non-amortizing loans include balloon mortgages (which require a large payment at the end) or interest-only mortgages.

Most lenders don’t offer these — and most home buyers don’t want them — because these loans are riskier and don’t help the borrower build equity as quickly.

With an amortized loan, your mortgage is guaranteed to be paid off by the end of the term as long as you make all your payments over the life of the loan.

Amortization schedule example

Here’s an example of how an amortization schedule would look for the following loan:

- Loan amount: $250,000

- Loan term: 30 years

- Fixed interest rate: 3.5%

- Fixed monthly principal and interest (P&I) payment: $1,123

Mortgage amortization table

Each payment is the same total amount ($1,123). But note how more than half the payment goes toward interest in the first year, while only $3 goes to interest at the end of year 30.

| Year | Principal Payment | Interest Payment | Principal Remaining | Interest Paid |

| 1 (Payment 1) | $393 | $729 | $249,607 | $729 |

| 5 (Payment 60) | $467 | $655 | $224,243 | $41,599 |

| 10 (Payment 120) | $556 | $566 | $193,567 | $78,281 |

| 15 (Payment 180) | $663 | $460 | $157,035 | $109,105 |

| 20 (Payment 240) | $789 | $333 | $113,527 | $132,953 |

| 25 (Payment 300) | $940 | $183 | $61,711 | $148,494 |

| 30 (Payment 360) | $1,121 | $3 | $0 | $154,144 |

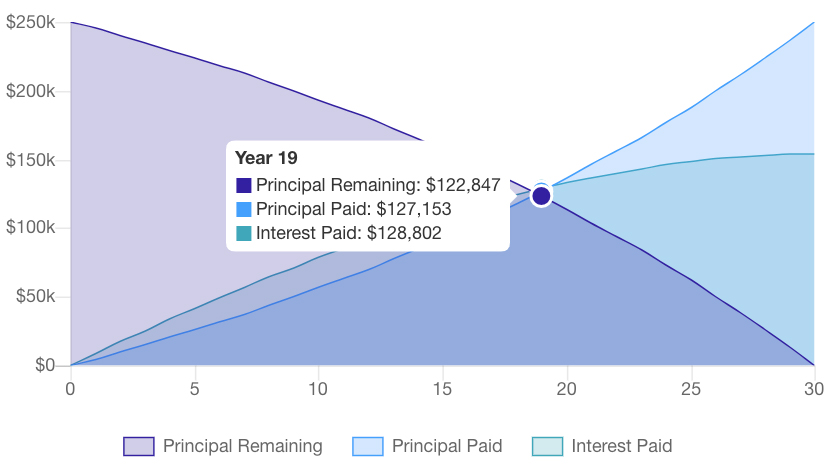

Mortgage amortization chart

As you can see on the sample chart below, it’s not until year 19 that the amount of principal the homeowner has paid surpasses the amount of interest.

Examples generated using The Mortgage Reports mortgage calculator

Amortization affects only principal and interest

Note that your amortization schedule affects only the principal and interest (P&I) portion of your mortgage payment.

Regular payments include other homeownership costs, too, like homeowners insurance, property taxes, and if necessary, private mortgage insurance and/or homeowners association (HOA) dues.

Payments for these other expenses will not change with your amortization schedule. However, they will change throughout the loan term. For example:

- Your property tax bill will change as your local government increases or decreases tax rates — and as the tax value of your property changes

- Your homeowners insurance premium could change, especially if you decide to switch insurers

- Your mortgage insurance premiums should change each year as your total principal balance decreases. And if you have a conventional loan, you can cancel your private mortgage insurance (PMI) completely once you’ve paid off 20 percent of the loan

- HOA dues can often increase, too, as HOA boards reevaluate fees each year

Mortgage lenders add these costs onto your principal and interest payments because lenders have a financial interest in keeping these bills paid.

Why your amortization schedule matters

“Amortization matters because the quicker you can amortize your loan, the faster you will build equity and the more money you can save over the life of your loan,” says real estate investor and flipper Luke Smith.

Look closely at your amortization schedule, and you’ll likely find that your loan will amortize a lot more slowly than you think, especially if you have a 30-year mortgage.

“Many borrowers have a hard time grasping just how little of their monthly payment early on in the life of their loan goes toward repaying principal, and how much of the monthly payment late in the life of their loan is devoted toward repaying principal,” says Johnson.

Homeowners might not pay attention to their amortization schedule, because their total payment does not change.

But if you want to tap home equity or pay off your loan sooner, those principal-versus-interest numbers start to matter.

Building home equity

At the end of a fully amortizing mortgage loan, you’ll own your home outright. Its value will be 100% equity. But because of the way mortgage loans amortize, that equity builds up slowly as you pay off the loan.

As a result, you can’t assume that completing half the loan term means you’ve paid off half your loan amount.

Consider the example above. Although the full loan term is 30 years, it will take the homeowner 19 years — nearly two-thirds of the term — to pay off half their loan principal.

If you took out the same loan amount ($250,000) with a 15-year term instead of a 30-year term, you will have paid off half the loan’s principal in year eight.

So a shorter repayment schedule doesn’t just help you save money on interest — it also helps you build tappable home equity more quickly.

Cashing out home equity

You need more than 20% equity to draw on your home’s value via a cash-out refinance or home equity loan. Your amortization schedule will help you understand when you can reach the magic number to become eligible for home equity financing.

Keep in mind, too, that home values typically rise over time. So you may have 20% equity in the home long before your amortization schedule says you’ll be paid down to that point.

Paying off your mortgage

Some homeowners decide to pay off their mortgage early as a way to save on interest payments.

One way to do this is by refinancing into a shorter loan term, like a 10-, 15-, or 20-year mortgage.

But for homeowners who don’t want the hassle and cost of refinancing, an alternative is to make extra or “accelerated” payments toward the loan principal. Early payments can be in the form of:

- One extra payment each year

- Extra money added to each monthly payment

- A one-time, lump sum payment

Early payments toward your loan’s principal balance can speed up your amortization schedule. You’ll save money because you won’t have to pay interest on the months or years eliminated from your loan term.

You can use an amortization calculator with extra payments to determine how quickly you might be able to pay off your remaining balance, and how much interest you’d save.

Should you pick a long or short amortization schedule?

Before deciding on a mortgage loan, it’s smart to crunch the numbers and determine if you’re better off with a long or short amortization schedule.

The most common mortgage term is 30 years. But most lenders also offer 15-year home loans, and some even offer 10 or 20 years.

So how do you know if a 10-, 15-, or 20-year amortization schedule is right for you?

Benefits of a short-term loan

The obvious benefit of a shorter amortization schedule is that you’ll save a lot of money on interest.

For example, consider a $250,000 mortgage at a 3.5% interest rate:

- A 30-year fixed-rate loan would cost you $154,000 in total interest

- A 15-year fixed-rate loan would cost you only $46,000 in total interest

“Short amortization schedules tend to be a sound financial decision if you are buying a starter home and want to build equity more quickly,” says Nishank Khanna, chief financial officer for Clarify Capital. “It means you’ll be paying more toward the principal upfront.”

Khanna continues, “Borrowers who make a large down payment or plan to make accelerated payments, or those who secure loans with low annual percentage rates can shorten their amortization schedule — thereby paying less money over the life of their loan and accruing home equity much faster.”

However, a shorter amortization schedule isn’t for everyone.

Drawbacks of a short-term loan

The biggest drawback to shortening your loan term is that monthly payments will be much higher.

Using the same example of a $250,000 loan at 3.5% interest:

- Monthly P&I payments on a 30-year loan are $1,200

- Monthly P&I payments on a 15-year loan are $1,600

The steep increase means many homeowners simply can’t afford a short-term mortgage.

In addition, choosing a shorter-term loan locks in your higher monthly payments — you’re obligated to pay the full amount each month.

With a longer-term loan, on the other hand, you can pay more to accelerate your amortization schedule if you wish. But you’re not committed to a higher monthly payment.

Check your mortgage loan options. Start here

Can you change your amortization schedule?

The good news is that even if you opt for a longer repayment schedule — such as a 30-year fixed-rate mortgage — you can shorten your amortization and pay off your debt more quickly by either:

- Refinancing to a shorter-term loan

- Making accelerated mortgage payments

Smith recommends making extra principal payments over choosing a 15-year loan.

“Get the most favorable rate and terms for yourself. Then, if more funds are available in your budget, pay your loan down more quickly than scheduled,” he says.

Smith explains that you can treat your 30-year loan like a 15-year loan by choosing to make larger or extra payments.

But the opposite is not true: You can’t treat your 15-year loan like a 30-year loan. You’ll have to make the larger, 15-year payments to keep the loan current.

When you’re choosing to make larger payments on your 30-year loan but “a financial challenge occurs and you need the funds, you can temporarily or permanently stop making accelerated payments without any problems or repercussions,” Smith says.

Should you shorten your amortization schedule?

“When interest rates are low and the majority of your payments are going toward principal, there may not be a strong case for paying off a mortgage more quickly,” Khanna suggests.

“If you think you can earn a higher return on your money through other investments like the stock market, avoid a shorter-term amortization schedule.

“Also consider that, when you pay off your mortgage earlier, you will lose out on tax breaks you may qualify for, such as the mortgage interest tax deduction, which can negate savings.”

Are adjustable-rate mortgages amortized?

Most home buyers — especially first-time home buyers — prefer fixed-rate mortgages. But lenders also offer adjustable-rate mortgages (ARMs).

With an ARM, you’d start with a fixed rate for a set period of time. Then, once the fixed-rate period expired, your loan’s interest rate would change periodically.

Most ARMs are fully amortized, like fixed-rate mortgages. But unlike a fixed-rate loan, you wouldn’t know your ARM’s complete amortization schedule up front.

Instead, your loan would re-amortize its current principal balance each time its rate changes — which can happen once per year.

Mortgage amortization FAQ

Yes, most mortgage loan types are fully amortized, including FHA loans which help borrowers with lower credit scores get competitive interest rates.

Borrowers who fall behind on their home or car loan payments could experience negative amortization. With negative amortization, the loan’s outstanding balance grows larger instead of smaller. Sticking to your loan repayment schedule will avoid negative amortization by paying off each month’s principal and interest charges.

Accountants think of amortization a little differently than mortgage borrowers. They use amortization to spread the cost of an intangible asset over its useful life. They also use depreciation and depletion to show the changing value of tangible assets on their balance sheets. Fortunately, mortgage borrowers have a much simpler way to use amortization schedules.

A mortgage calculator can show the amortization schedule for a fixed-rate loan. Just enter your interest rate, loan amount, loan term, down payment, and other variables. Then click on “view full report” to see a graph showing the loan’s amortization.

You can speed up any loan’s amortization schedule by making extra payments, or making larger-than-required payments, each month. Some borrowers aim for making one extra payment per year. Others prefer paying extra on their loan’s principal each month.

Whether to pay off a mortgage early is a personal decision. Some borrowers prefer investing their money somewhere else — in stocks or in a second home, for example — instead of paying off their mortgage sooner. You should meet with a financial planner if you need help weighing the pros and cons.

Mortgage amortization: The bottom line

The decision between a short- or long-term loan should depend on your personal finances.

If you have a lot of monthly cash flow, and you want to save on interest, choosing a 15-year loan or shortening your amortization schedule with extra payments could be a smart strategy.

If you have a tighter budget — or you want to invest your money elsewhere — the traditional 30-year amortizing mortgage makes a lot of sense.

Compare all your loan options before buying a home or refinancing. And make sure you understand how amortization will affect your monthly payments, as well as your home equity options further down the line.

Time to make a move? Let us find the right mortgage for you