Home buying settles down in the fall

Whether you’re looking to buy or sell a home, understanding the housing market can help you get a good deal.

Just like the temperatures, borrower activity tends to cool in the fall, making it typically a good time for home buyers.

The Mortgage Reports’ State of the Housing Market is a quarterly feature that goes through the latest trends of real estate; including prices, sentiment, and inventory data.

Verify your home buying eligibility. Start hereAt a glance...

- U.S. home price growth returns to pre-pandemic level, per CoreLogic

- For-sale listings hit snag, per Realtor.com

- New construction grows unexpectedly, per Census Bureau and HUD

- Existing property sales slow, per NAR

- New home sales jump annually, per Census Bureau and HUD

- Home buyers are bummed by interest rates, per Fannie Mae

- Mortgage lenders expand credit access, per the MBA

- Home builder confidence drops, per NAHB

Home prices

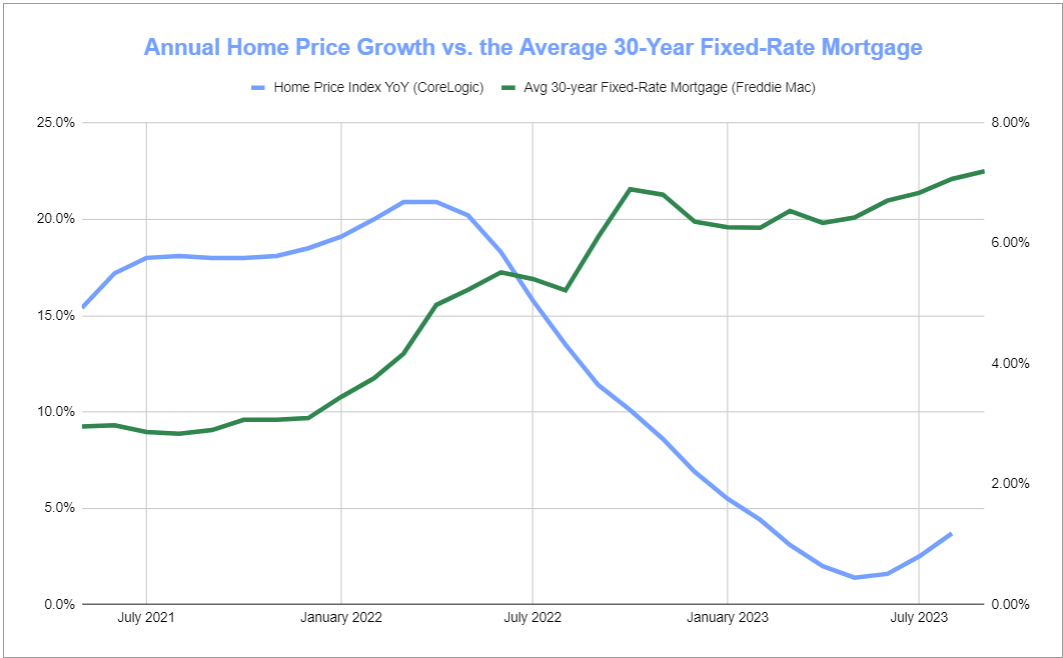

After setting records in 2021 and 2022, housing value appreciation returned to pre-pandemic levels in 2023.

U.S. single-family home prices rose 3.7% annually in August, according to CoreLogic’s Home Price Index. That marked the 139th consecutive month of positive year-over-year growth and the highest rate since February. Additionally, prices inched up 0.3% month-over-month.

Check your home loan options. Start here“While continued mortgage rate increases challenge affordability across U.S. housing markets, home price growth is in line with typical seasonal averages, reflecting strong demand bolstered by a healthy labor market, strong wage growth and supporting demographic trends. Still, with a slower buying season ahead and the surging cost of homeownership, additional monthly price gains may taper off,” said Selma Hepp, chief economist at CoreLogic.

At the state level, New Hampshire led the nation with a 9.4% annual gain. Maine and Vermont followed, both increasing by 8.9%. Eight states saw prices fall from the year before. The biggest drops came in Idaho at 4%, Montana at 2.7% and Nevada at 2.3%.

CoreLogic forecast a 0.2% increase in prices from August to September and a 3.4% bump by August 2024.

Housing inventory

The amount of available properties for sale at a given time greatly impacts real estate dynamics.

A bountiful for-sale market benefits buyers, while tight supply swings the pendulum of advantage toward sellers. The ongoing inventory shortage is perhaps the biggest detriment to the overall market, as demand overshadows supply.

The latest listing data

Active home listings decreased 4% annually in September, according to Realtor.com’s Housing Market Trends report. However, the total rose 4.9% from August.

“Buyers still struggle with the triple threat of rising listing prices, record-high mortgage rates, and limited inventory, making affordability a continued concern,” said Danielle Hale, chief economist for Realtor.com. “The number of homes for sale is likely to remain low as higher mortgage rates leave many homeowners feeling ‘locked in’ to their current rates.”

Among the 50 largest metropolitan areas, cities in the South gained the most inventory. Memphis, Tenn., led the way with a 35.6% year-over-year increase in active listings. New Orleans, San Antonio, Birmingham, Ala., and Oklahoma City filled out the top five, growing by 28.4%, 24.4%, 16.2% and 14.6%, respectively.

Conversely, the largest annual drops in active listings were mostly scattered in the West. The biggest declines came at 55.1% in Las Vegas, 44.3% in Phoenix, 36.9% in San Diego, 34% in Sacramento, Calif., and 28.7% in Seattle.

The pipeline

To look ahead, the Census Bureau and Department of Housing and Urban Development put together a joint Monthly New Residential Construction Report with three leading indicators of housing supply.

First, building permits hit a seasonally adjusted annual rate (SAAR) of 1.473 million in September. That figure fell 4.4% from August and 7.2% from September 2022.

Secondly, September housing starts reached a SAAR of 1.358 million. That jumped 7% monthly while dropping 7.2% annually. Lastly, housing completions grew to a SAAR of 1.453 million, increasing 6.6% month-over-month and 1% year-over-year.

“Despite ongoing challenges in the market, the housing deficit of resale inventory continues to provide some market support for builders,” said NAHB Chief Economist Robert Dietz. “Because of a lack of existing homes in the marketplace, 31% of homes available for sale in August were new construction. This compares with a historical average in the 12-14% range. But in another sign that higher interest rates have slowed the market, the number of single-family homes under construction in September was 674,000, which is almost 15% lower than a year ago.”

Home Sales

The total and frequency of sold homes provide a picture for how the sector is performing. It can also tell a story of where demand lies relative to supply and affordability.

In September, a SAAR 3.96 million existing homes sold, according to the National Association of Realtors (NAR). This declined 2% from August and 15.4% from September 2022.

Check your home loan options. Start hereBroken down by price tier, existing homes in the $250,000-$500,000 range accounted for the most transactions with 45% of sales. Among the country’s four major regions, the South led with a 46% share of sales, followed by 23% in the Midwest, 18% in the West and 13% in the Northeast.

“As has been the case throughout this year, limited inventory and low housing affordability continue to hamper home sales,” said Lawrence Yun, chief economist at NAR.

Sales of new homes had mixed results in August, according to the Census Bureau and HUD. The month had a SAAR of 675,000 new-home sales, a drop of 8.7% from July but a 5.8% increase from the year prior.

On a year-to-date basis, new-home sales rose 4.8% in the Northeast, 4.4% in the Midwest, and 1.9% in the South while falling 0.5% in the West.

“Sales weakened in August with average mortgage rates above 7%. Builders are being more cautious about managing their inventory in this rising rate environment,” said Robert Dietz, NAHB chief economist. “A year ago, 10% of the new home inventory listed for sale consisted of homes that had not yet started construction, and that share has now risen to 17% of the total inventory.”

How are home buyers feeling?

The general consensus among house hunters can shape market competition.

More demand — especially when for-sale inventory is low — can create frenzied bidding wars and accelerate home price growth. When home buyer conditions aren’t as opportune, borrowers may be able to get a relatively good deal on a property.

Verify your home buying eligibility. Start hereThrough a consumer survey, Fannie Mae’s Home Purchase Sentiment Index (HPSI) evaluates the overall view and outlook of the housing market through six components: Good time to buy, good time to sell, home price expectations, mortgage rate expectations, job loss concern, and household income. The index launched in 2011 and runs on a scale of zero to 100. It reached a high of 93.8 in August 2019 and a low of 56.7 in October 2022.

In September, the HPSI measured 64.5, down from 66.9 month-over-month but up from 60.8 year-over-year. The share of respondents who said it was a ‘good time to buy’ dropped a net four percentage points month-over-month. Meanwhile, ‘good time to sell’ fell seven percentage points from August.

“Mortgage rates persistently over 7% appear to be deepening the malaise consumers feel about the home purchase market,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “In fact, high mortgage rates surpassed high home prices as the top reason why consumers think it’s a bad time to buy a home, a survey first.”

How are lenders feeling?

Mortgage lenders constantly adjust their underwriting standards. Their willingness to approve and take on a home loan depends on both the borrower’s financial profile and the overall economic conditions at that point in time.

Find your lowest interest rate. Start hereWhen the economy runs hot, lender leniency tends to go up because those mortgages come with less risk. The opposite holds true during leaner times or recessions due to heightened uncertainty.

The Mortgage Bankers Association (MBA) measures this phenomenon with its Mortgage Credit Availability Index (MCAI). The MCAI has a baseline score of 100. Any score above that means lenders are more likely to extend credit while anything below indicates tighter standards.

The MCAI inched up from 96.6 in August to 97.2 in September. The index sat at 102.5 in September 2022.

“Credit availability increased slightly in September, as lenders increased their loan offerings marginally to meet the changing needs of borrowers who are facing higher mortgage rates,” said Joel Kan, MBA’s deputy chief economist. “There were more loan programs for ARM loans for borrowers seeking lower initial monthly payments and also some increases in non-QM product offerings.

How are home builders feeling?

Home builder sentiment ebbs and flows based on consumer demand, market conditions, shifting costs and supply chain status.

The National Association of Home Builders (NAHB) and Wells Fargo measure this sentiment on a 0-100 scale in their monthly Housing Market Index (HMI) survey. The survey is broken into three components: current home sales, home sales over the next six months and traffic of prospective buyers.

In October, builder confidence fell to 40, decreasing for the third month in a row. It edged down from 45 in September but rose from 38 one year earlier.

“Builders have reported lower levels of buyer traffic, as some buyers, particularly younger ones, are priced out of the market because of higher interest rates,” said NAHB Chairman Alicia Huey. “Higher rates are also increasing the cost and availability of builder development and construction loans, which harms supply and contributes to lower housing affordability.”

The bottom line

Whether you’re a buyer or seller, trying to understand the housing market at any given time can be difficult.

Many real estate experts will tell you it’s never a bad time to buy a house as long as you can comfortably afford it. But arming yourself with knowledge of the latest happenings in the marketplace can give you a leg up.

If you’re ready to start your journey of homeownership or sell your current property, reach out to a local mortgage professional today.

Time to make a move? Let us find the right mortgage for you