Make $40,000 per year or less? Here are 10 affordable cities where you might afford a home

As higher home prices and mortgage rates take their toll on affordability, many homebuyers are getting squeezed out of the market.

But not in these cities.

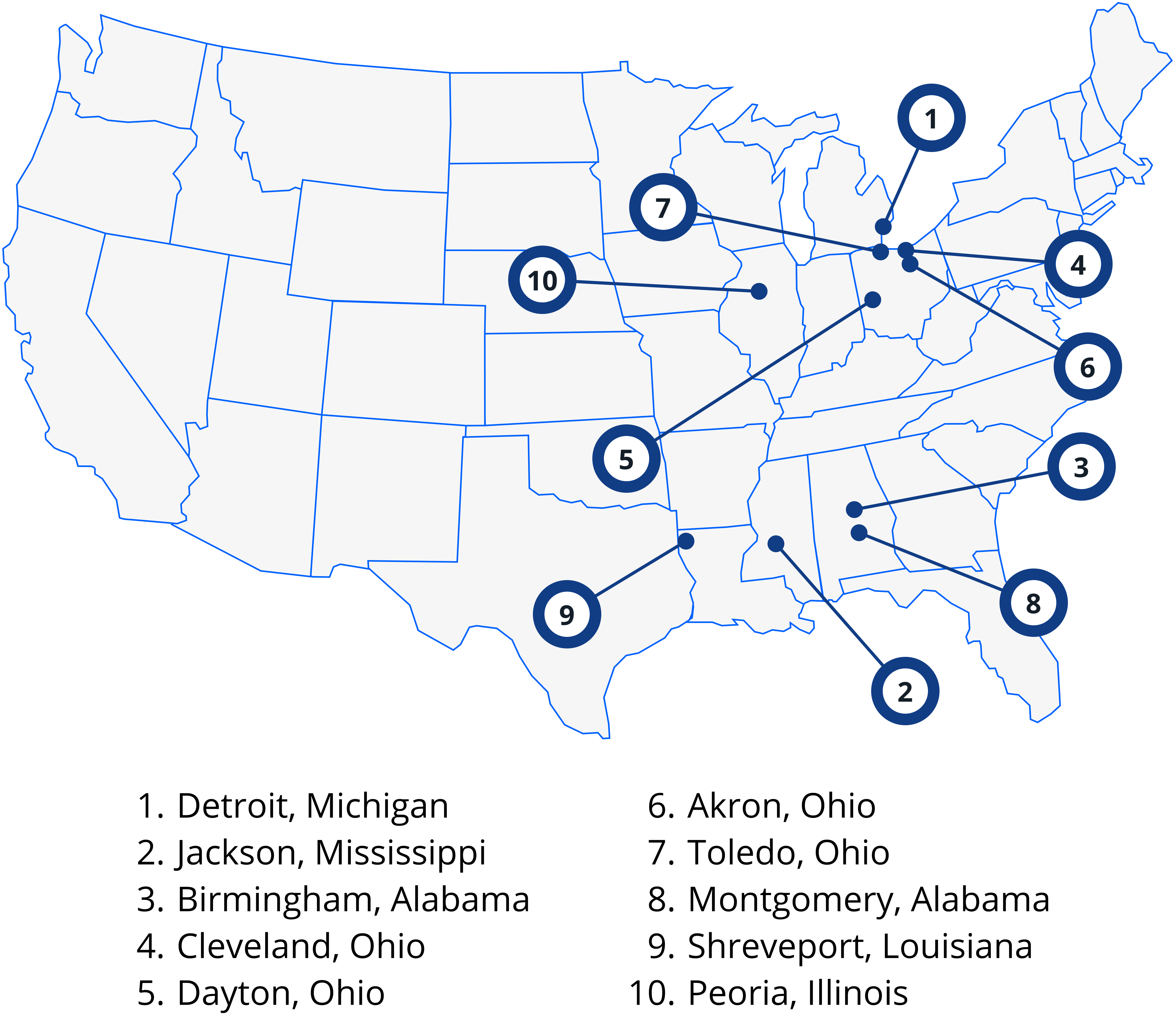

Out of over 300 cities analyzed, 10 offered a total house payment affordable for someone making $40,000 per year factoring in home prices, property taxes, and homeowner’s insurance for each location.

Verify your home buying eligibility. Start hereTop 10 cities to buy a home on $40K income

- Detroit, Michigan

- Jackson, Mississippi

- Birmingham, Alabama

- Cleveland, Ohio

- Dayton, Ohio

- Akron, Ohio

- Toledo, Ohio

- Montgomery, Alabama

- Shreveport, Louisiana

- Peoria, Illinois

#1 Detroit, Michigan. Income needed to buy: $23,671

| Home price | $62,621 |

| 5% down payment | $3,131 |

| Principal, Interest, PMI | $446 |

| Monthly property tax | $75 |

| Monthly homeowner’s insurance | $189 |

| Total house payment | $710 |

Once a thriving auto industry hub, Detroit is experiencing a renewal with projects like the $2.5 billion New Center development project funded by the Detroit Pistons, Henry Ford Health, and Michigan State University. Ten Fortune 500 companies call the region home including Ford, General Motors, and Rocket Mortgage, providing plenty of employment opportunities. Surprisingly, home prices are still rock-bottom, but may not be that way for long.

#2 Jackson, Mississippi. Income needed to buy: $26,148

| Home price | $70,115 |

| 5% down payment | $3,505 |

| Principal, Interest, PMI | $500 |

| Monthly property tax | $54 |

| Monthly homeowner’s insurance | $230 |

| Total house payment | $784 |

To afford the typical home in Jackson, we estimate you need to make just over$26,000 per year. Achieving this income level is made easier by the many employment opportunities in the city within the health, automotive, and education industries. The “City With Soul” isn’t all about work, though. Try just about every culinary style from cajun to Greek in this town, plus catch local and national musical acts in every genre.

#3 Birmingham, Alabama. Income needed to buy: $29,781

| Home price | $100,844 |

| 5% down payment | $5,042 |

| Principal, Interest, PMI | $719 |

| Monthly property tax | $46 |

| Monthly homeowner’s insurance | $128 |

| Total house payment | $893 |

With home prices just over $100,000, plus affordable property taxes and homeowner’s insurance, you may be able to purchase a home making well under $40,000 per year. The largest city in Alabama offers plenty to do, including a zoo, thousands of acres of wooded trails, and even a professional spring league USFL football team, the Birmingham Stallions.

#4 Cleveland, Ohio. Income needed to buy: $31,632

| Home price | $99,784 |

| 5% down payment | $4,989 |

| Principal, Interest, PMI | $711 |

| Monthly property tax | $126 |

| Monthly homeowner’s insurance | $112 |

| Total house payment | $949 |

One of four Ohio cities on the list, Cleveland makes the cut for good reason. An all-inclusive house payment of under $1,000 per month for the typical home is just one of the attractive features of this metro. For sports fans, the city hosts NFL, NBA, and MLB teams. Foodies will love a vast selection of everything from breweries to breakfast. The Cleveland Museum of Art brings the world to you, featuring art from Egypt, China, Japan, Germany, and more. Want all the amenities of a big city without the housing price premium? Try Cleveland.

#5 Dayton, Ohio. Income needed to buy: $36,130

| Home price | $109,351 |

| 5% down payment | $5,467 |

| Principal, Interest, PMI | $779 |

| Monthly property tax | $175 |

| Monthly homeowner’s insurance | $130 |

| Total house payment | $1,084 |

Dayton is home to many major employers, making it easier to buy already-affordable homes in the area. Wright-Patterson Air Force Base is the largest source of jobs, with over 27,000 employees. Other industries include healthcare, tech, and manufacturing. Military buffs will enjoy the National Museum of the U.S. Air Force and the world’s oldest aircraft factory in the world.

Verify your home buying eligibility. Start here#6 Akron, Ohio. Income needed to buy: $36,422

| Home price | $113,163 |

| 5% down payment | $5,658 |

| Principal, Interest, PMI | $807 |

| Monthly property tax | $174 |

| Monthly homeowner’s insurance | $112 |

| Total house payment | $1,093 |

Akron is home to a zoo, art museum, a minor league baseball team, a symphony, and much more. But you wouldn’t know there is so much to do in this city of 189,000 judging by its home prices. Forty miles south of Cleveland, it’s no surprise this city also offers similar housing costs.

#7 Toledo, Ohio. Income needed to buy: $36,491

| Home price | $112,740 |

| 5% down payment | $5,637 |

| Principal, Interest, PMI | $804 |

| Monthly property tax | $170 |

| Monthly homeowner’s insurance | $121 |

| Total house payment | $1,095 |

The fourth Ohio city on the list, Toledo offers typical home prices affordable for someone who can pay about $5,000 down and $1,100 per month. Though it’s a home shopper’s paradise compared to expensive locales on both coasts, Toledo offers most of the same amenities: waterfront activities (Lake Erie), museums, zoos, and more.

#8 Montgomery, Alabama. Income needed to buy: $38,579

| Home price | $138,580 |

| 5% down payment | $6,929 |

| Principal, Interest, PMI | $988 |

| Monthly property tax | $40 |

| Monthly homeowner’s insurance | $129 |

| Total house payment | $1,157 |

Montgomery is a major manufacturing hub. Hyundai, which calls the city home, adds some $4.2 billion to the Alabama economy each year. The $40,000 annual income needed to buy a house is quite attainable thanks to this and other employers in the area.

#9 Shreveport, Louisiana. Income needed to buy: $39,519

| Home price | $129,178 |

| 5% down payment | $6,456 |

| Principal, Interest, PMI | $921 |

| Monthly property tax | $81 |

| Monthly homeowner’s insurance | $184 |

| Total house payment | $1,186 |

If you’ve always wanted to own a home, Shreveport may be the place to do it. Not only are home prices affordable, but the city grants down payment assistance of up to 20% of the purchase price to lower-income families.

Verify your home buying eligibility. Start here#10 Peoria, Illinois. Income needed to buy: $40,548

| Home price | $115,042 |

| 5% down payment | $5,752 |

| Principal, Interest, PMI | $820 |

| Monthly property tax | $248 |

| Monthly homeowner’s insurance | $148 |

| Total house payment | $1,216 |

Rounding out our list is Peoria. It’s just two and a half hours from Chicago but offers homes at a fraction of the cost. OSF Healthcare and Caterpillar are two of the many employers in the region, making this town of around 100,000 a great place to work and live.

Should you relocate?

Those who can’t afford a home in their city have options. Many cities across the U.S. are affordable without a sky-high income. It’s just a matter of finding the right location. Homebuyers who want to lock in their housing costs and say goodbye to ever-rising rent should consider these and other affordable locales. They offer a similar quality of life compared to areas where prices have risen out of reach.

Time to make a move? Let us find the right mortgage for youMethodology

To determine cities where you can buy a home with a $40,000 annual salary, we analyzed home prices in more than 300 cities. To be affordable at this income level, the city’s typical home requires a total monthly payment of about $1,200 or less including:

- Principal

- Interest

- Mortgage insurance

- Property taxes

- Homeowner’s insurance

We used a 36% front-end (housing) debt-to-income (DTI) ratio, 30-year fixed conventional mortgage with 5% down and a 7.296% interest rate. Typical home values are from the Zillow Home Value Index (ZHVI) Single-Family Homes Time Series. We used city property tax rates from Roofstock. We gathered homeowner’s insurance city averages as well as median household income among homeowners from Policygenius. We assumed no HOA dues. To leverage the best data available, we analyzed cities with populations of 100,000 or more.