Tired of high rent? Here’s where you can own a home for just $1,100 per month including PMI, taxes, and insurance

The average apartment rent in the U.S. is $1,326 per month, but what if you could buy a house – yard and all – for $1,100 monthly?

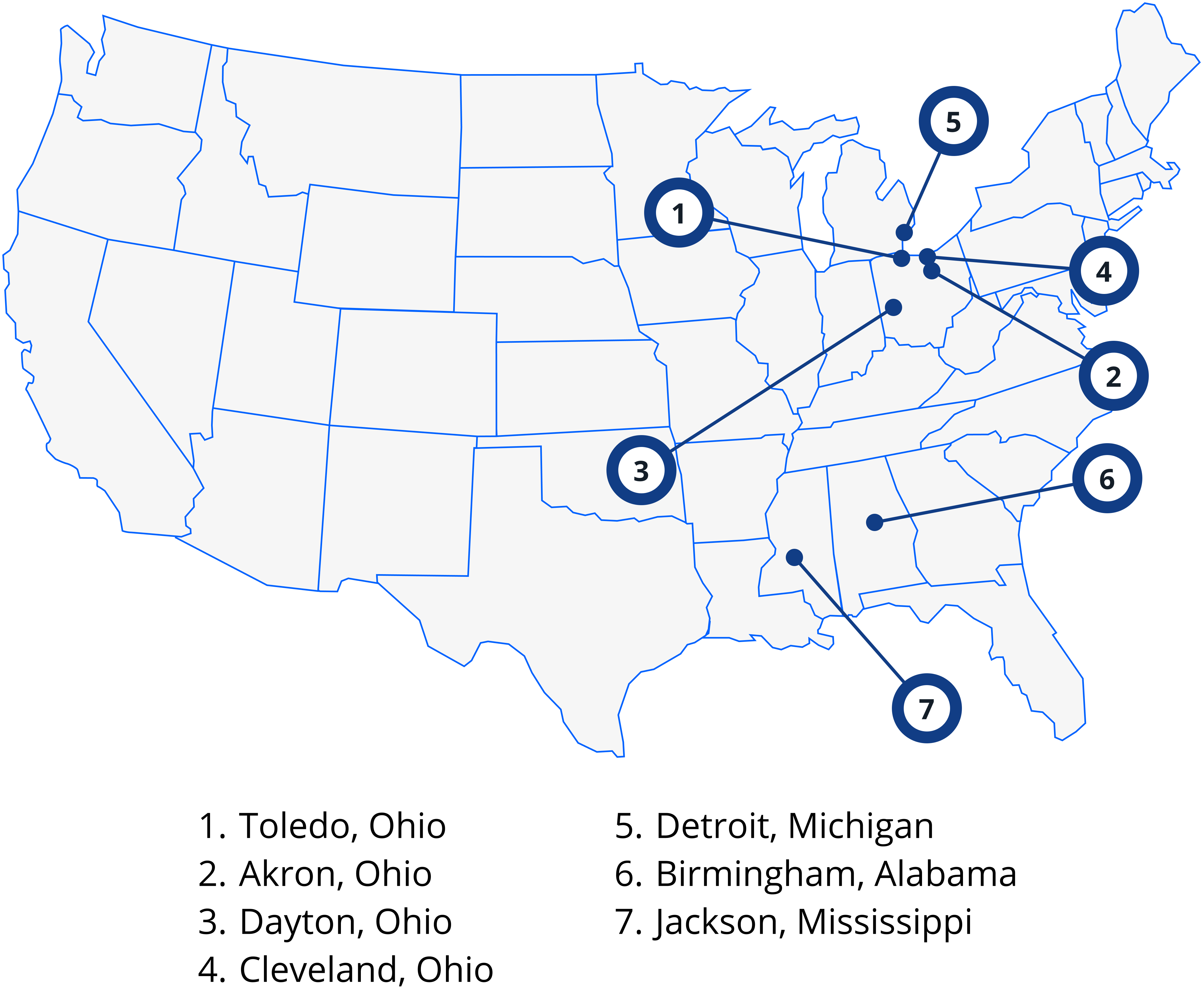

Out of over 300 cities analyzed, seven offered this payment level or less including principal, interest, PMI, taxes, and insurance. The best part: our study assumes only a 5% down payment.

Verify your home buying budget. Start hereThe ultra-low-cost cities from most to least expensive are:

- 7. Toledo, Ohio

- 6. Akron, Ohio

- 5. Dayton, Ohio

- 4. Cleveland, Ohio

- 3. Birmingham, Alabama

- 2. Jackson, Mississippi

- 1. Detroit, Michigan

Cities Where the Total House Payment Is $1,100 or Less

Here’s more about each one.

#7 Toledo, Ohio. Monthly payment: $1,095

| Home price | $112,740 |

| 5% down payment | $5,637 |

| Principal, interest, PMI | $804 |

| Monthly property tax | $170 |

| Monthly homeowner’s insurance | $121 |

| Total house payment | $1,095 |

One of four Ohio cities on the list, Toledo offers home prices affordable for someone making just $40,000 per year. The city offers waterfront activities on Lake Erie, museums, zoos, and more.

#6 Akron, Ohio. Monthly payment: $1,093

| Home price | $113,163 |

| 5% down payment | $5,658 |

| Principal, interest, PMI | $807 |

| Monthly property tax | $174 |

| Monthly homeowner’s insurance | $112 |

| House payment | $1,093 |

The housing market in Akron has been steady for years. But if you want to own a home there, you better act fast. New properties listed for sale cratered in 2023. There are likely more buyers than sellers, soaking up inventory. In November 2023, only around 600 homes came on the market.

Verify your home buying budget. Start here#5 Dayton, Ohio. Monthly payment: $1,084

| Home price | $109,351 |

| 5% down payment | $5,467 |

| Principal, interest, PMI | $779 |

| Monthly property tax | $175 |

| Monthly homeowner’s insurance | $130 |

| Total house payment | $1,084 |

Median rent in Dayton is $830, while an all-inclusive house payment is just $1,084. If you can find down payment assistance and swing an extra couple hundred dollars per month, you might as well own a home in this affordable locale.

#4 Cleveland, Ohio. Monthly payment: $949

| Home price | $99,784 |

| 5% down payment | $4,989 |

| Principal, interest, PMI | $711 |

| Monthly property tax | $126 |

| Monthly homeowner’s insurance | $112 |

| Total house payment | $949 |

Tired of bidding wars, seller’s markets, and buyer competition? Cleveland could be your cure. While it’s ranked as one of the “coldest” markets in the U.S. as far as new listings and home appreciation, that designation is welcome news for buyers. Home shoppers may get a home below market and face next to no competition.

#3 Birmingham, Alabama. Monthly payment: $893

| Home price | $100,844 |

| 5% down payment | $5,042 |

| Principal, interest, PMI | $719 |

| Monthly property tax | $46 |

| Monthly homeowner’s insurance | $128 |

| Total house payment | $893 |

The number of days the average home stays on the market in Birmingham is increasing, indicating less demand and less competition. Buyers here could get a great deal on a home making this already affordable place even more so. Homes were on the market a median of 53 days in November 2023, up from an all-time low of 29 in June 2022.

Verify your home buying budget. Start here#2 Jackson, Mississippi. Monthly payment: $784

| Home price | $70,115 |

| 5% down payment | $3,505 |

| Principal, interest, PMI | $500 |

| Monthly property tax | $54 |

| Monthly homeowner’s insurance | $230 |

| Total house payment | $784 |

For buyers making less than 80% of Jackson’s median income, the city offers a forgivable loan to cover the entire down payment of less $500 from the buyer’s own funds. Considering a 5% down payment is just over $3,500 for the typical home, this market is extremely accessible to many budgets.

#1 Detroit, Michigan. Monthly payment: $710

| Home price | $62,621 |

| 5% down payment | $3,131 |

| Principal, interest, PMI | $446 |

| Monthly property tax | $75 |

| Monthly homeowner’s insurance | $189 |

| Total house payment | $710 |

Detroit comes in at number one for affordable housing markets with an all-inclusive monthly payment of $710. Rock-bottom home prices and property taxes help it claim this title. And with over 8,000 listed homes city-wide, some for as little as $10,000, there’s sure to be a home for just about any budget.

Verify your home buying budget. Start hereFinding affordable homes in almost any city

While some people can’t relocate, there are strategies to find affordable homes in every city.

Whether you get down payment assistance, use a renovation loan on a fixer-upper, or fill the home with roommates, you can make a home more affordable with a little creativity and persistence.

Methodology

To determine cities where you can buy a home with an $1,100 monthly payment, we analyzed housing statistics in more than 300 cities. To determine the monthly payment, we started with the typical home price in the city, then calculated based on:

- Principal

- Interest

- Mortgage insurance

- Property taxes

- Homeowner’s insurance

We assumed a 30-year fixed conventional mortgage with 5% down and a 7.296% interest rate. Typical home values are from the Zillow Home Value Index (ZHVI) Single-Family Homes Time Series. We used city property tax rates from Roofstock. We gathered homeowner’s insurance city averages as well as median household income among homeowners from Policygenius. We assumed no HOA dues. To leverage the best data available, we analyzed cities with populations of 100,000 or more.

Time to make a move? Let us find the right mortgage for you