Winter housing market heating up?

Whether you’re looking to buy or sell a home, understanding the current housing market can help you get a good deal.

The winter usually serves as a lull before the ramp up to the busy spring home buying season. However, 2024 could be different as many prospective buyers and sellers sat on the sidelines, waiting for interest rates to come back down.

The Mortgage Reports’ State of the Housing Market is a quarterly feature that goes through the latest trends of real estate; including prices, sentiment, and inventory data.

Verify your home buying eligibility. Start hereAt a glance...

- U.S. home price growth hits 11-month high, per CoreLogic

- For-sale listings see bump, per Realtor.com

- December brings big growth for completed homes, per Census Bureau and HUD

- Existing-property sales hit December chill, per NAR

- New home sales strong - especially in the West, per Census Bureau and HUD

- Home buyers turn rosy, per Fannie Mae

- Mortgage lenders constrict credit access, per the MBA

- Home builder confidence grows, per NAHB

Home prices

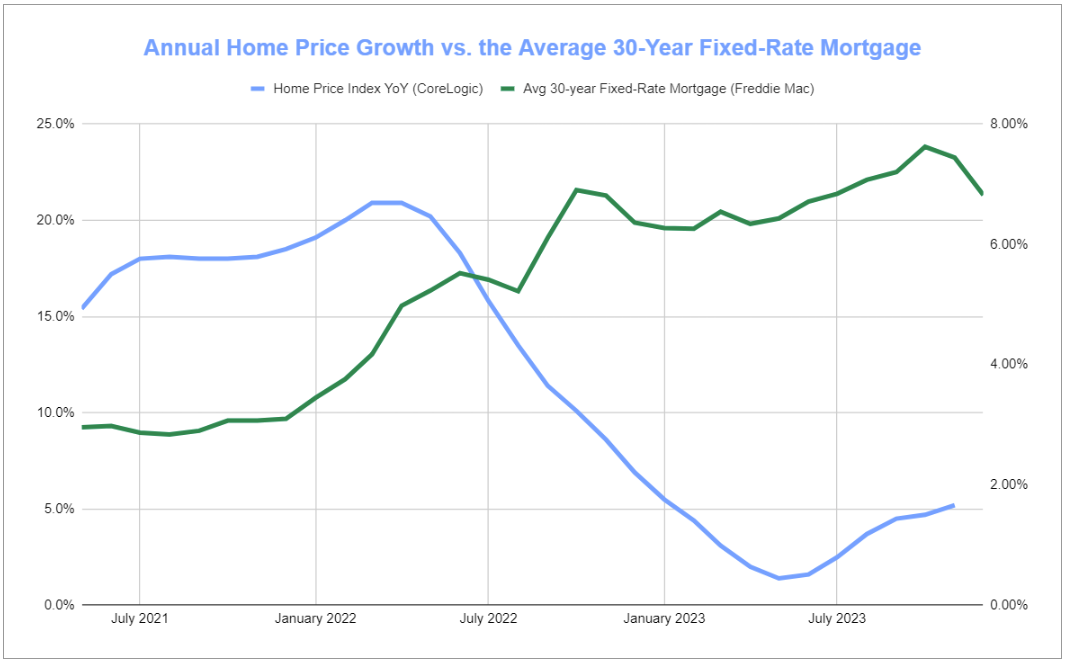

After setting records in 2021 and 2022, housing value appreciation returned to pre-pandemic levels in 2023.

U.S. single-family home prices rose 0.2% monthly and 5.2% annually in November 2023, according to CoreLogic’s Home Price Index. It marked the highest year-over-year rate since January 2023.

“While the annual growth reflects comparison with last year’s declines, seasonal gains remain in line with historical averages. However, in some metro areas, such as those in the Mountain West and the Northwest, higher interest rates are having a greater impact on homebuyers’ budgets, which is contributing to a larger seasonal slump. This continued strength remains remarkable amid the nation’s affordability crunch but speaks to the pent-up demand that is driving home prices higher. Markets where the prolonged inventory shortage has been exacerbated by the lack of new homes for sale recorded notable price gains over the course of 2023,” said Selma Hepp, chief economist at CoreLogic.

At the state level, the biggest price inclines came from the northeast. Rhode Island led the country with a 11.6% year-over-year jump. After, came gains of 10.6% in Connecticut and 10.5% in New Jersey.

CoreLogic forecast a 0.2% decrease in prices from November to December and a 2.5% bump by November 2024.

Housing inventory

The amount of available properties for sale at a given time greatly impacts real estate dynamics.

A bountiful for-sale market benefits buyers, while tight supply swings the pendulum toward sellers. The ongoing inventory shortage is perhaps the biggest detriment to the overall market, as demand overshadows supply.

Check your home loan options. Start hereThe latest listing data

Active home listings increased 4.9% annually but fell 4.7% monthly in December, according to Realtor.com’s Housing Market Trends report. Encouragingly for prospective home buyers, it was the second straight month of yearly inventory growth.

“Across the U.S. we’re seeing improvements in inventory levels, especially in the South, which experienced a 7.7% increase in active listings year-over-year,” said Danielle Hale, chief economist for Realtor.com. “We are optimistic that inventory levels are moving in a positive direction, but the number of homes on the market is still low relative to pre-pandemic levels. Some sellers are clearly motivated already, but other households may hold out for lower rates before selling or moving to new homes.”

Southern cities led the way in inventory gains among the 50 largest metropolitan areas. Memphis, Tenn., topped the list with a 28.5% year-over-year increase in active listings. New Orleans, San Antonio, Miami and Cincinnati rounded out the top five, with increases of 25.5%, 20.9%, 19.0% and 17.5%, respectively.

On the flip side, the biggest annual declines in active listings mostly came from Western locations. Las Vegas had the largest drop at 45.3%, followed by 23.2% in Phoenix, 19.5% in Sacramento, Calif., and 18.2% in both Los Angeles and Chicago.

The pipeline

To get an idea of what’s ahead, the Census Bureau and Department of Housing and Urban Development put together a joint Monthly New Residential Construction Report with three leading indicators of housing supply.

- Building permits hit a seasonally adjusted annual rate (SAAR) of 1.495 million in December. That figure rose 1.9% from November and 6.1% from December 2022.

- December housing starts reached a SAAR of 1.46 million. That fell 4.3% monthly but jumped 7.6% annually.

- December saw a SAAR of 1.574 million housing completions, increasing 8.4% month-over-month and 13.2% year-over-year.

“While monthly housing starts data can oscillate a lot, the general trend we are looking for is an increase in starts, particularly for single-family homes. Increase in building permits over the course of 2023 and generally more positive housing outlook for 2024 due to lower mortgage rates are all positive signs that homebuilders are cautiously optimistic about building new homes,” said Selma Hepp, chief economist at CoreLogic.

Home Sales

The total number of sold homes and the frequency at which they sell provide a picture for how real estate performs. It can also tell a story of where demand lies relative to supply and affordability.

In December, a SAAR 3.78 million existing homes sold, according to the National Association of Realtors (NAR). This drifted down 1% from November and 6.2% from December 2022.

Check your home loan options. Start hereBroken down by price tier, existing homes in the $250,000-$500,000 range accounted for the most transactions with 44% of sales. Among the country’s four major regions, the South led with a 46% share of sales, followed by 24% in the Midwest, 18% in the West and 12% in the Northeast.

“The latest month’s sales look to be the bottom before inevitably turning higher in the new year,” said Lawrence Yun, chief economist at NAR. “Mortgage rates are meaningfully lower compared to just two months ago, and more inventory is expected to appear on the market in upcoming months.”

Sales of new homes showed strength in December, according to the Census Bureau and HUD. New-home sales hit a SAAR of 664,000 for the month, increases of 8% from November and 4.4% from December 2022.

On a year-over-year basis, new-home sales increased 7.6% in the West, 6% in the Midwest, and 3.7% in the South while falling 2.9% in the Northeast.

“We are likely to see a soft but steady rebound in home sales which reflect pent up demand and optimism that has built over expectations of lower mortgage rates,” said Selma Hepp, chief economist at CoreLogic. “Builder surveys also show cautious optimism as we enter the new year. Permits are also up which will provide some relief in supply and will help keep home sales going if interest rates continue their downward trend throughout 2024, as expected.”

How are home buyers feeling?

The general consensus among house hunters can shape market competition.

More demand — especially when for-sale inventory is low — can create frenzied bidding wars and accelerate home price growth. When home buyer conditions aren’t as opportune, borrowers may be able to get a relatively good deal on a property.

Verify your home buying eligibility. Start hereThrough a consumer survey, Fannie Mae’s Home Purchase Sentiment Index (HPSI) evaluates the overall view and outlook of the housing market through six components: Good time to buy, good time to sell, home price expectations, mortgage rate expectations, job loss concern, and household income. The index launched in 2011 and runs on a scale of zero to 100. It reached a high of 93.8 in August 2019 and a low of 56.7 in October 2022.

In December, the HPSI measured 67.2, up from 64.3 month-over-month and 61.0 year-over-year. The share of respondents who said it was a ‘good time to buy’ rose a net five percentage points month-over-month. Meanwhile, ‘good time to sell’ fell five percentage points from November.

“Mortgage rate optimism increased dramatically this month, with a survey-high share of consumers anticipating mortgage rate declines over the next year,” said Mark Palim, deputy chief economist at Fannie Mae. “A more optimistic rate outlook among consumers may signal an expectation that home affordability pressures will ease in 2024.”

How are lenders feeling?

Mortgage lenders constantly adjust their underwriting standards. Their willingness to approve and take on a home loan depends on both the borrower’s financial profile and the overall economic conditions at that point in time.

Find your lowest interest rate. Start hereWhen the economy runs hot, lender leniency tends to go up because those mortgages come with less risk. The opposite holds true during leaner times or recessions due to heightened uncertainty.

The Mortgage Bankers Association (MBA) measures this phenomenon with its Mortgage Credit Availability Index (MCAI). The MCAI has a baseline score of 100. Any score above that means lenders are more likely to extend credit while anything below indicates tighter standards.

The MCAI fell to 92.1 in December, down from 96.5 in November and 103.3 the year before.

“Credit availability declined in December to the lowest level since 2012, as ongoing industry consolidation is resulting in more loan programs being removed from the marketplace,” said Joel Kan, MBA’s deputy chief economist.

How are home builders feeling?

Home builder sentiment changes alongside consumer demand, market conditions, shifting costs and supply chain fluidity.

The National Association of Home Builders (NAHB) and Wells Fargo measure this sentiment on a 0-100 scale in their monthly Housing Market Index (HMI) survey. The survey is broken into three components: current home sales, home sales over the next six months and traffic of prospective buyers.

The downtrend in mortgage rates helped builder confidence increase to 37 in December after four months of declines. It stood above November’s score of 34 and December 2022’s 31.

“Builders are reporting an uptick in traffic as some prospective buyers who previously felt priced out of the market are taking a second look. With the nation facing a considerable housing shortage, boosting new home production is the best way to ease the affordability crisis, expand housing inventory and lower inflation,” said NAHB Chairman Alicia Huey.

The bottom line

Whether you’re a buyer or seller, trying to understand the housing market at any given time can be difficult.

Many real estate experts will tell you it’s never a bad time to buy a house as long as you can comfortably afford it. But comprehending the latest happenings in the marketplace can give you a leg up.

If you’re ready to become a homeowner or sell your current property, reach out to a local mortgage professional today.

Time to make a move? Let us find the right mortgage for you