A new report turned up big racial divides in mortgage approval

A recent report by LendingTree revealed stark inequality when it comes to qualifying for mortgages.

It showed that Black borrowers are significantly more likely to be denied for a mortgage than those from other demographics, with denial rates at 12.64% compared to 6.15% for the rest of the borrowing population.

The reasons for this disparity are complex. Housing discrimination has a long history in the U.S., the effects of which are still widely felt today.

We’ll take a brief look at that history here.

But we’ll also explain reasons for mortgage denial at the individual level — for any applicant — and what you can do to better your chances of approval.

In this article (Skip to...)

- New data on mortgage denials by race

- Why do underwriters deny mortgages?

- Ways to improve your chances of getting approved

- FAQ: Mortgage denials and underwriting

- Background on racial disparities in mortgage approval

- A note on accessible mortgage programs

New data on mortgage denials by race

LendingTree’s new report analyzes data on mortgage and refinance denials, which lenders are required to report under the Home Mortgage Disclosure Act.

It found that BIPOC people were more likely than white people to be denied for a mortgage or refinance — in some cases at nearly twice the rate.

There are deeply-rooted, complex reasons for these disparities, a discussion we take up briefly toward the end of this article.

But there are also surface-level reasons for mortgage denial — the actual number(s) a lender can point to and say “this is why we didn’t approve the application.”

If you’ve had trouble getting a mortgage or refinance in the past, it helps to understand those reasons so you know how to improve your chances in the future.

Verify your mortgage eligibility

Why do underwriters deny mortgages?

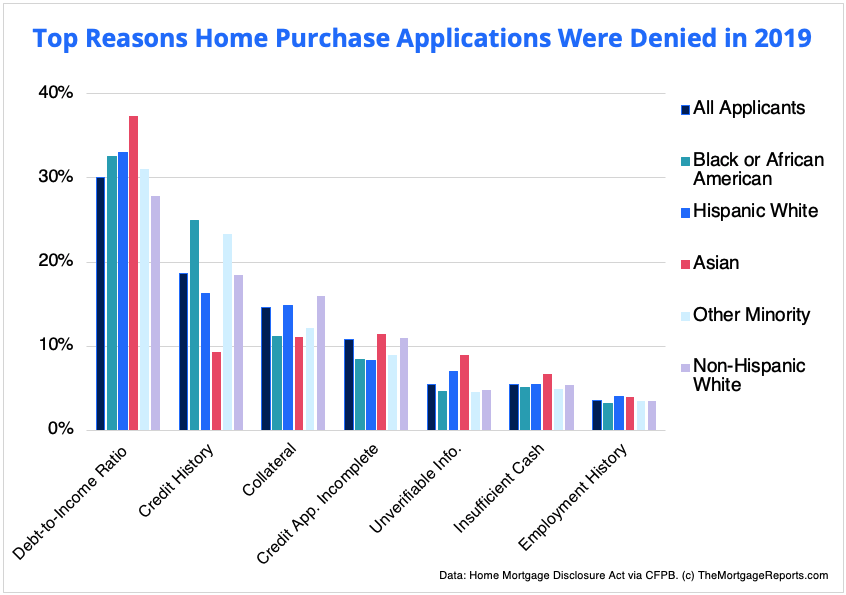

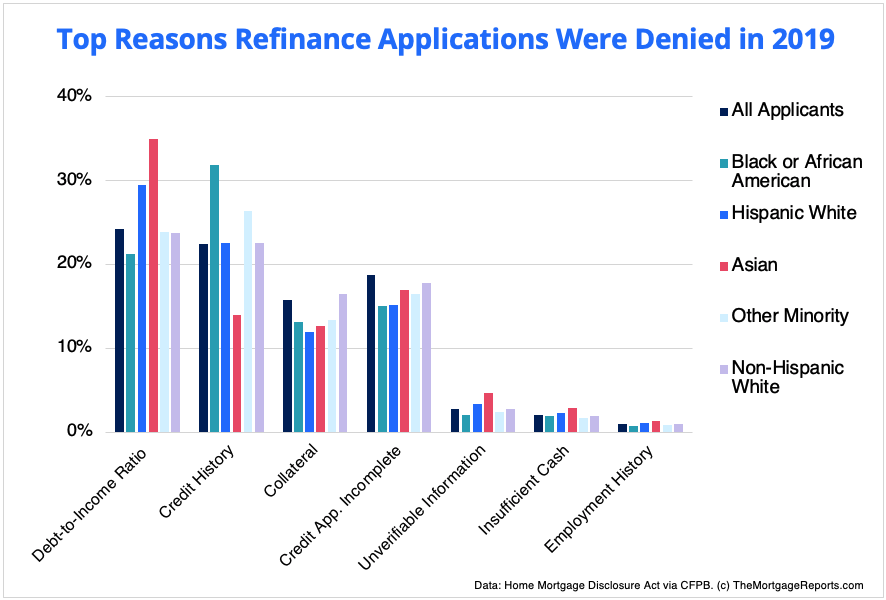

The Consumer Financial Protection Bureau (CFPB) broke down the reasons for mortgage and refinance denials in 2019 by race.

CFPB found that, across all demographics, credit history and a problematic debt-to-income ratio (DTI) are the leading reasons borrowers are denied home loans.

The numbers look similar for refinance applications that were denied in 2019.

Reasons for mortgage denial explained

It’s clear that a history of discriminatory policies created and sustained the homeownership gap among Black and white borrowers.

But it’s helpful to understand what the different denial reasons mean so you can make yourself a competitive applicant, particularly as lenders and institutions are being forced to examine their policies:

- Debt-to-income ratio (DTI): DTI refers to how much you earn vs. how much you pay on debts such as loans and credit cards each month

- Credit history: Your credit history shows all of your credit accounts, including credit cards, personal loans, auto loans and student loans. Lenders look for a history of on-time payments, and they like to see accounts that have been open and in good standing for several years

- Collateral: Collateral is an asset you can use to secure a loan. When you take out a mortgage, your house serves as collateral the lender can repossess and sell if you default on your payments. If you choose to borrow against the equity in your home, the house will also serve as collateral

- Credit application incomplete: Lenders might deny an application if you haven’t filled out all of the information on your employment history or finances. Typically, a lender will reach out and try to fill in the gaps, then deny the loan if they receive no response or an insufficient reponse. They can also deny you if they don’t have enough credit data in your file to determine your risk level as a borrower, according to the CFPB

- Insufficient cash: When you apply for a loan, lenders look to see that you have enough cash in your accounts to cover your down payment plus closing costs and fees. If your account doesn’t show sufficient funds, they may deny your application

- Employment history: Lenders want to see a history of consistent employment and income. Typically, they’ll want to verify that you’ve been employed for the past two years

- Unverifiable information: Loan officers and underwriters are meticulous when they review your application. If they can’t verify details such as your income, address history and employment, they may deny your application. They’ll also be looking for discrepancies such as large withdrawals on accounts that don’t appear on your credit report. Let’s say you’re on a payment plan for a medical bill, and the payment comes out automatically each month. If that bill doesn’t show up on your credit report — and you don’t disclose it when you apply — the lender may deny you because your transaction history doesn’t align with the information they have

These are the main reasons a lender would deny a mortgage or refinance application.

With that in mind, here are a few things to do, if you’re able, that may improve your chances of success when you apply for financing.

How to improve your chances of getting a mortgage

1. Maintain a low debt-to-income ratio

Most lenders prefer to see a DTI of 36% or lower (including your potential mortgage payments) for conventional loans.

Government-backed loans, like FHA, can be much more forgiving, allowing debt-to-income ratios up to 45% or 50% in some cases.

The best way to avoid getting dinged on your DTI is to keep your debts as low as possible. Some tangible ways to do it are as follows:

- Accept a longer term on your auto loan and/or buy a less expensive car

- Keep credit card balances low. You will be “dinged” with the minimum monthly payment which is usually a percentage of the current balance.

- Consolidate student loans. Get the monthly payment as low as possible.

Fortunately, lenders don’t look at utilities, cell phone bills, or other non-credit monthly recurring costs when calculating DTI.

2. Keep an eye on your credit

If you’re not sure what your credit score is, or which accounts are showing up on your report, request a copy of your credit report before you apply.

You are entitled to a free copy of your report from the three credit bureaus — TransUnion, Equifax, and Experian — every year.

But due to the strain COVID-19 has put on the economy, everyone is now entitled to free weekly credit reports through April 2021.

Even if your credit card company offers a free credit check option, you still want to request your full report. The score that appears on the report is more accurate, and you can review all of your accounts to make sure all the information a lender will see is current and correct.

If you see an account you didn’t open or any fraudulent activity, report it to the credit bureau right away.

3. Build up collateral

When purchasing a home, insufficient collateral means that the home you’re buying doesn’t meet minimum standards for FHA or another home loan agency.

For instance, the roof needs replaced or there are hazards at the property like faulty electrical system or a deteriorating back deck.

In this case, look into an FHA 203k loan, which allows you to buy and fix up the property with one transaction.

If you’re refinancing, the lender needs to see that you have enough equity to do so. Some loans require as much as 20% equity to refinance. However, newer loan types like the High LTV Refinance Option (HIRO Loan) allow you to refinance into a lower rate even if you have zero or negative equity.

If you’re looking to turn your home’s equity into cash someday, be sure you are making extra payments each year. As you pay down your mortgage, you’ll increase the equity in your home. The more equity you have, the more borrowing power you’ll have if you choose to do a cash-out refinance or take out a home equity loan or line of credit.

Avoid borrowing against your home equity unless you need to so the funds are available for major expenses, such as renovations.

4. Save up cash reserves

In addition to the money you’ve saved for a down payment, it helps to have funds in savings that show you can cover your monthly payments. The longer the money is in your account, the more secure and stable your finances appear (this is known as “seasoned money”).

5. Be thorough when filling out your application

This is an easy one: Before you turn in your mortgage application, double and triple-check that every field is filled out. And make sure that you respond to any requests from your lender for more information.

Data shows that over 10% of mortgage applications — and nearly 20% of refinance applications — across all demographics were denied simply because the credit application was incomplete.

Verify your mortgage eligibility

FAQ: Mortgage denials and underwriting

Lenders deny mortgages for several reasons, but the most common are poor credit scores or a “thin file,” meaning the borrower has a limited credit history.

Sometimes a thin file is a good thing, as some people prefer not to use credit at all and instead pay for everything with cash. In other cases, they may be too young to have built up credit or have been denied loans and credit cards in the past, effectively preventing them from building a credit profile.

Depending on the reason for the thin file, lenders may be willing to use alternate documentation such as utility or rent payments to qualify you.

A high DTI is also a leading factor in a mortgage being denied, as is a history of late payments or defaults. If you’ve ever declared bankruptcy or been foreclosed on, that can hurt your chances as well.

But there are lenders who work with borrowers that are trying to rebuild after a financial crisis, so even if you’ve had these issues before, you may be able to buy a home.

As with mortgages, refinance applications are often denied because of the borrower’s DTI or credit history. A refinance may also be denied if you don’t have enough equity in your house or you owe more than the home is worth.

You can apply with other companies (and you should — it’s wise to apply with at least three lenders to ensure you’re getting the best deal).

You may want to search for lenders who work specifically with people in similar financial circumstances as you.

For instance, some lenders specialize in helping borrowers with low credit scores, poor credit histories, a history of bankruptcy or foreclosure, or people who are self-employed or seasonal workers.

If multiple lenders deny your application, ask plenty of questions about why you were denied and how you can improve your chances of qualifying within the next several months or years.

Some lenders will work with you to figure out exactly how much debt you need to pay off to reach their required DTI or hit their minimum credit score. You always want to find out the next best steps toward qualifying.

Most mortgages get approved, though about 11% were denied in 2018 according to MarketWatch. That same year, one in four refinances were denied.

A denial doesn’t hurt in and of itself, but lenders will do a hard credit check when they run your application, and that can lower your score. A hard credit check, or hard pull, stays on your credit report for two years.

But if all of your accounts are in good standing, you make your payments on time and your credit utilization (the amount of credit you’re using vs. the amount that’s available to you) is below 30%, the hard check should make only a small dent.

Most lenders want to see a 36% DTI for a standard mortgage. However, some will accept higher DTIs and the criteria often vary depending on the type of loan programs they offer.

Generally speaking, you’ll need at least a 580 to qualify for a government-backed FHA mortgage. Lenders may offer loans with lower credit requirements, or they can tighten lending criteria depending how the broader economy is doing.

But 580 is the minimum number to aim for, and the higher your score, the more money you’ll qualify for — and at better interest rates.

Lenders typically look for a credit score of 620 for a conventional refinance. But as with mortgages, they may accept lower scores based on the loan options offered at their institution.

Why are there racial disparities in mortgage and refinance approvals?

The homeownership gap between Black and white Americans is caused by a number of factors, a deep study of which is beyond the scope of this article.

However, it’s unfair to look at disparities in things like credit, income, and debt, without at least mentioning the history behind them.

While the reasons for mortgage denial may look individual on the surface — one person’s credit score, one person’s debt ratio — they can’t be separated from a larger history of discriminatory policies.

Housing discrimination in the U.S.

As Wealthsimple detailed in 2019, the roots of the problem go back to the 1930s, when the Federal Housing Administration (FHA) engaged in discriminatory lending standards known as “redlining.”

The problem was exacerbated in the 1940s, when many lenders would not give low-interest mortgages to Black veterans, despite the fact that they were entitled to the benefit under the GI Bill.

Black people who were denied government-backed mortgages often sought alternative loans. But these were purposefully marketed with predatory terms and rates that made it extremely difficult to build equity and long-term wealth, according to Wealthsimple.

The disparities seen today are rooted in policies and discriminatory practices of the past, and they are perpetuated by inequalities in access to credit and other financial opportunities.

Mortgage denial rates

Today, there are fair housing and equal credit laws meant to protect home buyers from the types of discrimination codified in the past. But current laws can’t wipe out that history.

Take a look again at the rates of mortgage denial.

LendingTree’s study shows that:

- The largest mortgage approval disparities were in the Midwest

- Black borrowers in Milwaukee, Cleveland and St. Louis were most likely to have their mortgage applications denied

- In Milwaukee, the denial rate for Black prospective homebuyers is 17.73%, whereas the overall denial rate is 5.57%

- The disparities apply to refinancing as well

- In Phoenix, the difference between denials for Black refinance applicants and the general applicant pool was more than 22%.

But the reasons behind these rates are complex.

ProPublica found that Black people were more likely to have judgments brought against them and their money seized if they defaulted on their utility bills than white people.

Not only could this wipe out someone’s bank accounts and hurt their credit scores, it could leave them without enough money to pay down other debts or save for large expenses, like a mortgage.

CNBC also reported that under current credit-scoring models, BIPOC people are often rendered “credit invisible,” perhaps because of a lack of commonly tracked credit accounts. It’s very difficult to obtain a mortgage without a documented credit history.

Black college graduates are also significantly more likely to carry student debt than their white peers, and student debt is a big reason potential home buyers might have high DTI.

These are just a few of many factors influencing the racial wealth gap in the U.S.

A note on accessible mortgage programs

There are a number of mortgage programs designed to help anyone who faces tougher credit and debt hurdles.

If you’ve had trouble qualifying for a mortgage in the past — or anticipate having a harder time when you do apply — make sure you explore all your loan options.

A traditional, conventional loan with 20% down isn’t the only thing available. Take a look at

- FHA loans

- USDA loans

- VA loans

- Freddie Mac’s Home Ready loan

- Fannie Mae’s HomePossible loan

- The Conventioanal 97 loan

These and other mortgage programs are geared toward borrowers with lower credit scores, and/or lower income, and/or higher debt levels.

If you face any of the issues that commonly cause mortgage denial, one of these programs could make home buying a lot more accessible.

Time to make a move? Let us find the right mortgage for you