This week’s mortgage rates are the lowest in a month

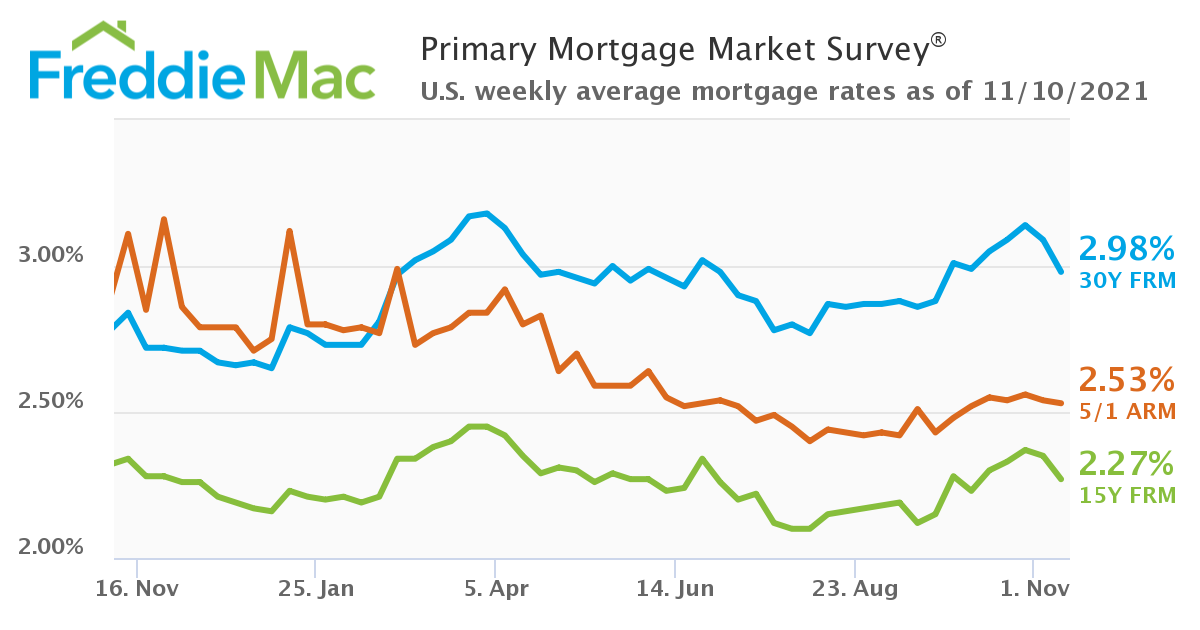

On Wednesday, Freddie Mac’s weekly mortgage rate survey reported an average 30-year fixed rate of just 2.98%.

This is the first time we’ve seen average 30-year mortgage rates below 3% since September.

Borrowers in a position to lock a rate are in luck. Few experts expected rates to drop this month, and this could be a rare window of opportunity to lock a rate near or below 3% before they rise again.

Find your lowest mortgage rate. Start hereWhat are today’s mortgage rates?

Freddie Mac’s weekly mortgage rate survey, released on November 10, puts average 30-year interest rates at 2.98%. According to the survey, 15-year fixed rates are sitting at 2.27%, and 5/1 ARM rates are at 2.53%.

Source: Freddie Mac

These are the lowest mortgage rates since September, according to Freddie’s survey. And they come as a welcome reprieve after rates spiked by 26 basis points (0.26%) between September and early November.

Find your lowest mortgage rate. Start hereWill mortgage rates keep dropping?

The short answer is, likely not.

In fact, mortgage rates had already ticked back up slightly by the time Freddie Mac’s data was released.

Keep in mind that Freddie Mac collects mortgage interest rate data on Monday and Tuesday of each week. But the data is released on Wednesday or Thursday. That means mortgage rate trends can change — for better or worse — by the time Freddie’s numbers come out.

In this case, mortgage rates were on the rise mid-week.

Our own data showed an average 30-year conventional mortgage rate of 3.149% (3.168% APR)* on Wednesday, November 10 — the same day Freddie Mac was citing 2.98% rates for that loan type.

For a more in-depth analysis of what’s moving current mortgage rates, check out our daily mortgage interest rate update.

Who can get a mortgage rate below 3%?

There’s always one big caveat when talking about mortgage rate trends — which is that the current rates shown are averages. Some borrowers will get higher rates, and some will get lower rates.

That means rates in the high-2% and low-3% range might still be available to ‘prime’ borrowers.

What does a prime borrower look like?

Typically, you’ll get the lowest mortgage rates if you have:

- A credit score of 720 or higher

- A 20% down payment (if buying a home)

- At least 20% home equity (if refinancing)

- A debt-to-income ratio below 36-43%

In addition, it’s crucial to shop around for your best mortgage offer.

Mortgage lenders have a lot of flexibility with the rates and fees they offer. So you might find you save a lot upfront — or in the long run — by shopping for a lower interest rate and closing costs.

It’s even possible to negotiate your interest rate and fees.

In today’s mortgage market, fewer borrowers are looking to buy or refinance their homes than last year. And many lenders are eager to get new business. So you may have more leverage to negotiate your costs if you get lenders to compete with one another.

Compare rates from multiple lenders

Borrowers who compare interest rates from just 3-5 lenders are proven to save money on their home loans.

Despite today’s rising rates, there are still great deals to be had for savvy shoppers.

If you’re looking to buy a home or refinance your current mortgage, do your due diligence. Compare offers from at least 3 mortgage companies to maximize your savings and get the best deal you can in today’s market.

Time to make a move? Let us find the right mortgage for you*Average interest rates are for sample purposes only. Your own rate may be different. See our rate assumptions here.