What exactly is a physician mortgage loan?

Physician loans, also called “doctor loans”, have special benefits for MDs and other medical professionals.

A physician mortgage might save you money through lower fees and loan costs. Or, it might make it easier for new doctors to qualify for a mortgage fresh out of medical school with a new job and student loan debt.

Some physicians will do well with a specialized mortgage loan, while others may find their best bet is a traditional mortgage program. Explore what’s available and choose the best deal for you.

Find the right loan for you. Start hereIn this article (Skip to...)

- Physician loan benefits

- How do physician loans work?

- Qualifying for physician loans

- Banks that offer doctors loans

- Down payment assistance for doctors

- Downsides of physician loans

- Rate shopping

- Physician loan alternatives

- Physician loans FAQ

Benefits of physician loans

Some differentiate between physicians and surgeons. But mortgage lenders don’t. When they talk about physician loans, or doctor mortgage loans,, they mean ones for doctors, generally. Some count other healthcare professionals, too, including veterinarians, dentists and orthodontists with DMV, DPM, DDS and DMD degrees.

These loans can deliver some very special privileges to those in the profession, including:

- No private mortgage insurance (PMI), even if your down payment is small or zero

- Low fees on closing

- Affordable access to jumbo mortgages — usually those over $

- Approval based on a signed employment contract rather than pay stubs

- Fewer hassles over student debt

- May be easier to get a self-employed mortgage with a shorter job history

But some mortgage insiders warn there are cons with physician loans as well as pros. So read on to discover the basic facts about the doctor loan.

How do physician loans work?

Physician loans allow doctors and medical professionals to purchase a home earlier than they would with a conventional loan.

You can qualify for a physician loan with no money down, flexible employment history, or a higher than normal debt-to-income ratio — without any primary mortgage insurance requirement.

Since PMI is generally around 0.5% to 1% of your loan amount per year, the PMI waiver benefit can save homeowners thousands of dollars.

Who qualifies for a physician loan?

Most physician mortgage programs are aimed at medical residents, medical doctors, attendings, fellows, and primary care physicians. But it’s up to each lender to decide who qualifies. Many include dentists and optometrists, and some include veterinarians.

The list of eligible medical specialists who qualify for a physician loan is dependent on the mortgage lender, so be sure to talk to your loan officer about eligibility.

In general, these medical professionals often qualify for physician loan programs:

- Medial doctors (MD)

- Nurse Practitioners (NP)

- Doctors of Chiropractic (CD)

- Doctors of Dental Medicine (DMD)

- Doctors of Dental Surgery (DDS)

- Doctors of Optometry (OD)

- Doctors of Pharmacy (PharmD)

- Doctors of Podiatric Medicine (DPM)

- Doctors of Veterinary Medicine (DVM)

It’s also up to lenders to choose the other criteria they’ll use when deciding whether to lend and the mortgage rate they’ll charge.

Many lenders will be extra-lenient on physicians — even those without a traditional two-year employment history — because their high earning potential makes lending a very safe prospect.

Indeed, some estimate that physicians default on loans at a rate of 0.2% while consumers generally do so about six times as often.

But remember, income isn’t the only thing that matters.

The golden rule still applies: The higher your credit score and down payment, and the more stable your finances, the better the interest rate you’re likely to be offered.

Find the right loan for you. Start hereCredit score

To get the very best rates, you’re likely to need a credit score of 720 or higher.

But don’t worry if you don’t have that. There’s a reasonable chance of finding a physician loan even if your score’s down at 680 or so. You’ll just pay a bit more for it.

Two other factors might be taken into account if your credit score is lower than you’d like:

- If the rest of your loan application is strong: If you have a chunky down payment and very few other debts, your lender may be less worried about your score

- If your credit score is low because you have a "thin file": In lender speak, a “thin file” arises because you haven’t borrowed much in the past, leaving your credit record a little sparse. That’s a lot more forgivable than your having “earned” your low score through financial mismanagement

Mortgage lenders may be more indulgent when it comes to physicians. But they still expect you to meet basic credit requirements.

Down payment

It’s perfectly possible to find doctor home loans that require no money down at all. Yes, you might need some cash for closing, though some allow you to roll those costs up within your loan.

Others are happy to lend you 80%, 90%, 95% or more of the home’s appraised value.

Avoiding mortgage insurance when your down payment is low or zero is one of the biggest advantages offered by physician mortgage loan programs.

Crucially, physicians may have access to these low- or zero-down loans without mortgage insurance.

That insurance is a real burden for non-physician borrowers with small down payments. They can end up paying hundreds of dollars every month to protect their lenders from the risk of their defaulting.

So avoiding mortgage insurance when your down payment is low or zero is one of the biggest advantages offered by physician mortgage loan programs.

Debt-to-income ratio

We’ve covered two of the three things that mortgage lenders look at most closely when deciding whether to offer you a loan and how good a deal you’re due.

The third is your debt-to-income ratio or “DTI.”

DTI is “a person’s monthly debt load as compared to their monthly gross income.”

To get the “debt” number, you add up your monthly debt payments (minimum monthly payments on credit cards, student loan payments, alimony, child support ...) plus your inescapable housing costs, such as new mortgage payment, housing association fees, and property taxes.

How big a chunk of your pretax monthly income does that represent?

If it’s less than 43%, most lenders will think that’s fine. If it’s more, many borrowers have problems, though some lenders allow up to 50% for certain types of mortgages. Still, physicians may get some extra leeway.

Check today's best rates. Start hereHealthcare workers: Buying a house with student loans

New doctors and healthcare workers often have large amounts of student debt. And that can make home buying tough.

Not only does a big debt payment decrease your cash flow, but it also increases your debt-to-income ratio. This can make it harder to get mortgage qualified.

One option is to defer your student loan payments. But be aware that if your deferment ends within 3 years, most mortgage lenders will still calculate a monthly payment (equal to 1% of your loan balance) and factor that into your DTI. So your loans will still impact you.

Another option could be to ask your employer about student loan assistance. Some healthcare workers have benefit packages where the hospital will cover at least part of their student loan payments.

If you can prove to your mortgage lender that your hospital is helping foot the bill on your loans, it could reduce your DTI and improve your chances at purchasing a home.

Can doctors get mortgages without a two-year employment history?

One common issue new doctors face when trying to get a conventional mortgage is a lack of employment history.

Whether you’re a salaried employee or a self-employed contractor, mortgage lenders typically want to see a two-year history of steady income to qualify you for a conventional home loan.

Doctors fresh out of medical school, or brand new to their own practice, won’t have that two-year documentation to back them up. This is usually grounds to deny someone a mortgage.

It may be possible to get a physician mortgage loan on the strength of a contract or offer letter alone, or with as little as 6 months self-employment history.

That’s where doctor home loans come in.

Lenders are often happy to approve physicians and other medical professionals with little employment history, thanks to their high earning potential.

Thus, it may be possible to get a physician loan on the strength of a contract or offer letter alone. And self-employed doctors might be able to get a mortgage based on as little as six months’ self-employment history.

Which banks offer physician loan programs?

Scores of banks and credit unions across the country have physician mortgage loan programs. Some are relatively small, but a number are larger names you’ll have heard of.

Here’s a sampling of banks that offer special mortgage programs for physicians.

- Bank of America

- Arbor Financial Credit Union

- Chemical Bank

- Fairway Independent Mortgage

- Fifth Third Bank

- First National Bank

- Huntington National Bank

- KeyBank

- Lake Michigan Credit Union

- loanDepot

- Regions Bank

- US Bank

- SunTrust Mortgage (including BB&T Bank. Now, together, Truist Bank)

- TD Bank

- University Federal Credit Union

You’ll see they’re in alphabetical order. And that’s because we’re not trying to rank them. But links to lender reviews are provided where available.

Down payment assistance for doctors

There are thousands of down payment assistance programs (DPAs) across the country. The majority of these are designed to help lower-income or disadvantaged home buyers achieve their goals of homeownership, so high-earning physicians may not qualify for aid.

But if you need it, you may qualify for a grant, or a low- or zero-interest loan to help with your down payment. And some loans are forgivable after you’ve spent a certain length of time in residence (primary residence in the home, not the hospital).

Also check out the “Nurse Next Door" program, which is open to doctors as well as nurses, medical staff, and support staff. It offers grants of up to $6,000 and down payment assistance of up to a little over $10,000.

Downsides of a physician loan

If you read around the subject of physician home loans, you’ll find some dire warnings. Whether they should bother you will depend on your personal circumstances and the lender and program you choose.

The following are some things to look out for.

Potential for higher rates

Because you’re a low-risk borrower, lenders should be able to offer you a lower rate without ripping you off. But some may hope you’re better at medicine or surgery than money.

So watch out for higher rates than normal. You may find that some lenders offer seemingly low closing costs by increasing your monthly mortgage payments over the lifetime of your loan.

And think carefully about whether or not an adjustable mortgage rate suits you.

Many doctors benefit from these if they know they’ll be moving to a new job in a few years. And many other borrowers have saved through adjustable-rate mortgages’ (ARMs’) lower rates over the last decade or so. But you need to be clear they work for you.

Deferring student loan payments could set you back

There are circumstances in which this is a legitimate concern. Supposing you’re a new doctor fresh out of medical school and your student loans are still in their grace period.

Many physician mortgage loan programs ignore your student loan debt. So you could borrow big. But the only way to keep on top of your monthly mortgage payments is to forbear on your student loan payments during your residency.

And that means you’ll be accumulating interest on those loans as well as paying interest on your mortgage. This could be expensive in the long run.

Buy now or save a bigger down payment?

If you wait until you have a 20% down payment saved, you’ll pay way less in interest over the lifetime of your mortgage. That’s indisputable.

By the same logic, if you wait until you’ve saved 100% of the purchase price, you won’t pay any interest. But what you will have paid is a pile of rent.

One consideration should play a role in your decision to save up or buy now. And that’s what’s happening to home prices.

Historically, home prices and inflation have been on a steady upward trend. And when home prices are rising, it often makes sense to buy sooner rather than later using a low-down-payment mortgage or physician loan program. That way, you’ll benefit from inflation and gain home equity more quickly.

Plus, if you wait to buy and home prices keep rising, you’ll be chasing a higher down payment the longer you save.

Keep in mind, you can always refinance out of a less favorable loan program later on.

Don’t forget to comparison shop

By all means, check out the mortgage lenders offering special home loans for physicians. But don’t make those lenders your only options.

Different lenders offer very different mortgage rates and deals. And the same lender can offer significantly better or worse value at different times and to borrowers with only slightly different profiles.

If you, as a physician, are buying a more expensive home than most, you stand to save even more by rate shopping.

Federal regulator the Consumer Financial Protection Bureau (CFPB) reckons, " ... failing to comparison shop for a mortgage costs the average homebuyer approximately $300 per year and many thousands of dollars over the life of the loan.”

And that’s an average. If you, as a physician, are buying a more expensive home than most, your losses stand to be even greater.

Use your Loan Estimates

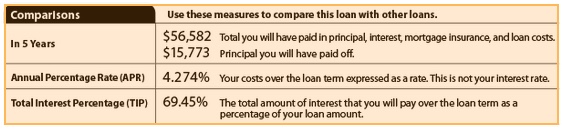

The easy way to assess the different deals you’re offered is to make side-by-side comparisons of Loan Estimates from at least four different lenders. These are now standardized with the same information and layout. So it’s easy to compare them.

In particular, look at page three, where you’ll find what you’ll have paid after five years. Here’s a sample, from the CFPB’s website:

For detailed information on how to compare mortgage offers, see: How to shop for a mortgage and compare mortgage rates.

Alternatives to physician loan programs

Just because you qualify for a seemingly generous program, doesn’t automatically make it your best bet.

Conventional mortgage loans, available to all, may end up being your most affordable option when interest rates and fees are tallied up.

Conventional and government-backed loans

| Conventional loan (30-year fixed rate) | % (% APR) |

| Conventional loan (15-year fixed rate) | % (% APR) |

| FHA loan (30-year fixed rate) | % (% APR) |

| FHA loan (15-year fixed rate) | % (% APR) |

| Va loans (30-year fixed rate) | % (% APR) |

| Va loan (15-year fixed rate) | % (% APR) |

*Interest rates and annual percentage rates for sample purposes only. Average rates assume 0% down and a 740 credit score. See our full loan VA rate assumptions here.

Conforming and jumbo loans

If you have decent credit and at least 3-10% down, you’re free to shop the mortgage market.

And you may find that your solid finances and creditworthiness can get you a deal that’s as good or better than any offered by doctor home loans.

That may be especially true if you’re shopping in the jumbo loan market — for homes over the conforming loan limit of $. The more you spend on the home, the more you’ll pay in interest. So you want to scrutinize your options extra carefully.

Be sure to consider all your options, research the most promising, and act decisively.

Physician loans FAQ

While specific loan terms will vary by loan program and lender, many mortgage loans, including physician loans, have no early-repayment penalty, which means you can refinance at any point. Refinancing a physician loan into a lower rate conventional mortgage may make sense as both your income and home equity increase and your debt-to-income ratio decreases.

Every bank will have its own set of rules and disclosures, but eligible borrowers may take out as many physician loans as they like. Some lenders even allow two physician loans at the same time when owners are moving from one primary residence to another. Keep in mind that physician home loans are generally only for owner-occupied homes and not an investment property.

Doctor loans are generally not underwritten with a fixed rate, but you may find a lender that offers one. You’ll most likely find that most doctor mortgages are adjustable-rate loans, which means monthly mortgage payments will fluctuate over the life of the loan.

Rates depend on a number of factors, including the lender and the type of loan. For the most part, physician loans typically carry higher rates because of the lower down payment requirements — or no money down at all — and waived private mortgage insurance. Mortgage rates change daily; so rate shopping is key to getting a good deal.

Today’s low rates

Physician loans may be a valuable option for eligible borrowers, but it’s important to shop your mortgage around to get the best deal for your financial circumstances.

Time to make a move? Let us find the right mortgage for you